Part 1: Assessing the Russian Geopolitical Threat to NATO

The Russian Military Is Prepared for a Long War

Through his invasion of Ukraine, Russian President Vladimir Putin has made clear that the freedom and security of Europe depend on the West’s ability to deter and defend against Russia. Unfortunately, while Russia is taking enormous losses in Ukraine, it is learning and rapidly reconstituting its military. On the eve of the Washington summit, the Kremlin’s ability to threaten the North Atlantic Treaty Organization with military force is real and pressing.

Russia’s military policy to wear down Ukraine and the West by sustaining a prolonged war depends on a stable wartime economy footing, a resilient defense industry, and three principal warfighting capabilities: artillery, heavy armor, and manpower. Like the Soviet Red Army, Putin’s combat formations rely on mass firepower, large amounts of heavy armor, and massed troop formations with favorable force-to-terrain and force-on-force ratios. In the meantime, drone and missile strikes terrorize Ukrainian population centers.

Methodology

It is difficult to determine Russia’s real military power. Continuing old Soviet habits, official Kremlin data is often exaggerated for propaganda purposes. Still, it points at a trend. Adjusting Russia’s prewar defense industrial factory outlook to account for the country’s current 24-hour workload also offers some insight. Likewise, open-source intelligence can help track the military assistance Russia has received. For example, the number of North Korean containers carrying ammunition or imagery of the Iranian drone plant in Tatarstan can define the upper and lower bounds of Russia’s acquisitions. Another critical indicator is Russian artillery employment in Ukraine. Comparing Russian units’ artillery usage over defined periods of time can suggest when supplies are high and when they are low. Last, official bodies like the United Kingdom Ministry of Defense now offer declassified intelligence, and a number of Western think tanks, including Hudson Institute, monitor the latest open-source intelligence.

The problems with assessing NATO’s capacities are categorically different. Official numbers are more accurate and transparent due to accountability. The biggest unknown, however, is military readiness. While we have a detailed combat record of almost every Russian formation involved in the invasion of Ukraine, most standing NATO armed forces have not seen action for a long time.

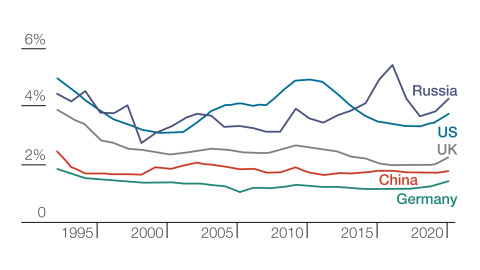

Russia’s economic resiliency may also continue to cause trouble for NATO. While Moscow has written off the $300 billion that Western nations have frozen, it holds roughly $580 billion in foreign currency and gold reserves. This financial cushion helps Russia continue investing heavily in its military. Since its invasion of Ukraine, Russia’s defense expenditures have fluctuated between roughly 4 and 6 percent of its gross domestic product (GDP), significantly higher than the NATO average in recent decades. And Russia’s military expenditures have proven highly resilient to economic fluctuations compared to China and the West, which have invested a lower percentage of their GDPs in defense despite having stronger economies (see figure 1).

Figure 1. Military Spending as a Share of GDP between 1992 and 2020

Source: Chatham House.

In 2024, Russia is prepared to allocate more than 6 percent of its GDP to its military, the most since Soviet times. More troubling for the West, the Kremlin has seen some economic gains from the war. In line with assessments of how arms expenditures can drive industrial growth, the Russian economy grew at a rate of 4.9 percent in July 2023.

Strategic industries related to the war have propelled this performance. Production of transportation-related infrastructure has risen 66.7 percent since 2022, computers and electronics 42.6 percent, and navigation devices 72.4 percent. Russia’s food industry has also grown. With defense production ramping up, Russia had a record-low unemployment rate of 3 percent last year.

Though official Russian data should be viewed with skepticism, the Russian military’s operational tempo in Ukraine to date suggests that the production of armaments and munitions has risen. State-owned conglomerate Rostec, headed by career Soviet-Russian intelligence officer Sergey Chemezov, has driven much of this production increase. According to the Kremlin’s calculations, Russia’s main battle tank production has increased sevenfold in one year. Moscow also reportedly quadrupled the production of armored platforms and more than doubled the production of artillery and rocket systems. According to Russian officials, ammunition production has seen a sixtyfold hike. Likewise, Russia claims that drone production saw an 80 percent increase in 2023. Russian arms production is on a stable trajectory, and evidence suggests that Russian defense companies have transitioned their factories to 24-hour schedules, shortened testing times, and accelerated contract fulfillment.

In late December 2023, the Russian Ministry of Defense announced that it received 1,500 main battle tanks that year, an average of 125 pieces per month. While Moscow lost between 600 and 870 tanks in 2023—roughly 50 to 73 tanks per month—its production levels remain robust even when assuming that a substantial amount of these tanks were modernized, not produced from scratch.

The Russian defense industry continues to cannibalize the thousands of Soviet-remnant main battle tanks in storage for spare parts. According to Russian sources, before the war, the T-90 baseline had a one-to-three ratio of new production to modernization. This trend is unlikely to change while Moscow still has these legacy systems in reserve. However, Russia’s tank performance will ultimately hinge on whether Uralvagonzavod, its largest tank manufacturer, can produce new T-80s, T-72B3s, and T-90s.

Artillery is another critical component of Russia’s ability to sustain a long war. State-owned Rostec produces the bulk of the weapon systems that Russia employs in Ukraine, and the company took control of 15 new enterprises in early 2023 to boost Russia’s artillery production capacity. Present assessments conclude that Russia is producing artillery rounds around three times more quickly than the United States and Europe combined, and at a lower cost. While early estimates suggested that Moscow could produce around 3 million artillery shells annually, recent forecasts say that the Kremlin can produce closer to 4.5 million per year. So while Russia’s official production numbers are likely exaggerated in many cases, there is no doubt that the country’s military production numbers have increased since the beginning of the war.

Available data suggests that the Russian military possesses roughly 5,750 main battle tanks, 9,000 to 10,000 other armored platforms, more than 10,000 pieces of tube artillery and mortars, and more than 3,000 rocket launchers. Russia’s combat formations, for example, are estimated to have 7,500 pieces of towed artillery, primarily drawn from stored Soviet-remnant pieces that numbered 12,000 before the war.

Russia also operates certain formidable weapons that NATO should keep an eye on. The TOS-1A Buratino 220mm-class heavy flamethrower, for example, can deliver thermobaric warhead–tipped rockets that ignite fuel-filled aerosol clouds that draw oxygen out of the surrounding air. Simultaneously, the weapon delivers a destructive blast that can reach temperatures of 5,432 degrees Fahrenheit (3,000 degrees Celsius). The Russian defense industry has used an even more lethal variant of this baseline, the TOS-2 Tosochka, in Ukraine. Other Russian weapons, such as the 240mm-class heavy mortar Tyulpan, provide further destructive capabilities.

Rostec is also producing the Koalitsiya-SV self-propelled howitzer. With an autoloader married to an uncrewed turret, this system has a better rate of fire than other 152mm-class Russian tube artillery. Built on a T-90 chassis, the Koalitsiya-SV can reportedly fire up to 16 shells per minute and hold 70 rounds internally, an upgrade from the 2S19 Msta-S self-propelled howitzer, which fires some 10 rounds per minute and stores up to 50 shells. These artillery systems pose a serious threat, even to NATO member states.

The Kremlin’s ability to generate manpower also bodes well for its long-term war aims. In his March 2024 speech to the Officers’ Club at Ramstein Air Base in Germany, US Secretary of Defense Lloyd Austin offered a quick overview of Russia’s losses in Ukraine: over 315,000 troops killed or wounded in action, more than $211 billion spent on the invasion, and a substantial portion of its Black Sea Fleet destroyed. Shortly after Austin’s speech, however, American officials admitted that Moscow replenished its ranks more quickly and effectively than anybody expected. US analysis now acknowledges that the Kremlin has managed to significantly rebuild its fighting forces.

The Russian military has consistently bolstered its ground forces despite heavy losses in Ukraine. Before the invasion, the Russian Armed Forces comprised roughly 900,000 troops and officers. In August 2022, Putin signed a decree adding 137,000 men in uniform. In December 2023, the Kremlin added 170,000 more fighters, raising its total to 1.32 million men. Official data shows that 490,000 servicemen, mainly conscripts, joined the Russian military in 2023. This is likely in part due to the Kremlin’s generous terms: Russian contract troops are paid 210,000 rubles, or $2,300 per month, to fight Putin’s war. As of early 2024, some 470,000 Russians were involved in the invasion of Ukraine.

On the equipment front, field reports suggest that the Russian invasion force currently possesses roughly 4,780 barrel artillery pieces, more than 1,100 multiple-launch rocket systems, 2,000 main battle tanks, and 7,000 armored vehicles. It also operates 290 rotary-wing and 310 fixed-wing aircraft. Thus, even according to mainstream Western assessments, Russia has combat deployed an invasion force in Ukraine that outnumbers most standing NATO militaries.

Assessing the Russian Aerospace Forces

The Russian Aerospace Forces (VKS) have both notable strengths and glaring weaknesses. Russia’s successful 2015 air campaign in the Syrian civil war led many Western analysts to overestimate the potency of Russia’s aerial capabilities. Notably, Moscow’s adversaries in Syria had no credible mid- to high-altitude air defenses or air-to-air combat capabilities.

In fact, the Kremlin’s efforts in Syria revealed the weakness of Russian airpower. In the opening stages of the campaign, the VKS deployed mostly Su-25 attack aircraft, Su-34 fighter-bombers, and Su-24 frontline bombers from the main Russian base in Syria, Khmeimim. Of these aircraft, the Su-24M delivered most salvos, often indiscriminate attacks on static targets in urban areas. Unguided munitions accounted for 80 percent of Russia’s strikes. Thus, whatever successes Russia achieved in Syria were not because of advanced air warfare capabilities—a stark contrast to how NATO’s Operation Allied Force used high-tech airpower to win in the Balkans in 1999.

As the last few years have shown, the Armed Forces of the Russian Federation struggle to adapt to crowded and complicated battle spaces in joint operations. Russian writings assessing the 2008 war in Georgia highlight unexpected aircraft losses from friendly fire incidents, which were caused by command and control failures and a lack of deconfliction among the Russian Air Force, local ground forces, and Russian air defenses.

In a conflict, NATO aircraft face little threat from Russian tactical military aviation assets. Russian Flanker-baseline fighters are no match for Western capabilities in the air, especially with the proliferation of fifth-generation F-35s among NATO members. Other fourth- and 4.5-generation aircraft—such as the Eurofighter Typhoon and the F-16, especially the latest F-16V variant equipped with an active electronically scanned array (AESA) radar—would likely make quick work of the VKS, albeit with greater losses than squadrons of fifth-generation tactical military aviation assets.

Still, NATO faces three challenges in combating the Russian air threat. First, should the Russian military succeed in a limited land invasion, it would immediately establish surface-to-air missile (SAM) coverage over any captured territory. In this scenario, NATO airpower would need to fly intensive missions focused on the suppression and destruction of enemy air defenses (SEAD and DEAD).

Second, Russia’s electronic warfare (EW) capabilities could interfere with NATO communications and sensor networks. EW activity could harm NATO’s operational enablers and force multipliers, from high-altitude drones to airborne early warning and control (AEW&C) aircraft. Thus, NATO would need to dominate the electromagnetic spectrum from the outset of the conflict.

Third, Russian mixed strike packages featuring drone and missile assets, similar to what Iran has used in the Middle East, would pressure NATO’s air and missile defenses. The offense-dominant nature of sophisticated joint drone and missile strike operations means that NATO militaries should acquire large numbers of defensive weapon systems coupled with sufficient quantities of long-range counteroffensive deterrents to target Russian launch positions both preventively and in retaliation. The Army Tactical Missile System (ATACMS) and the Joint Air-to-Surface Standoff Missile-Extended Range (JASSM-ER) are two such systems.

Despite these three threats, combat in Ukraine has exposed the most serious weakness of the VKS: its lack of high-tech kill chains and precision-guided munitions. It remains to be seen if China will supply Russia with advanced sensor suites, precision-guided munitions, targeting pods, and aerial missiles that would enhance Moscow’s capabilities.

An Emerging Coalition Threatens NATO

The Kremlin did not plan for a long war in Ukraine. The Russian intelligence community’s deeply flawed intelligence preparation of the battlefield (IPB) misled military planners and convinced Moscow that its full-scale invasion would be a larger-scale reenactment of its 2014 takeover of Crimea.

That the war is now in its third year has had huge consequences for the Russian Federation. Perhaps most notably, the Kremlin increasingly relies upon Iran, North Korea, and China to field the critical military capabilities a long war requires.

To understand the Russian defense industry, one should start with the 90/90 formula: Moscow imports 90 percent of its machinery tools, of which military producers purchase 90 percent. For example, Rostec, Russia’s largest producer of military equipment, purchased 80 percent of all cutting machines in the country even before the 2014 invasion of Crimea. With the full-scale invasion of Ukraine, the conglomerate devotes almost all its machinery to military industries. The machinery sector, in turn, directly impacts Russia’s missile production.

Missiles are indispensable components of what Russian theorists call noncontact warfare, or beskontaktnaya voyna, under the Russian theory of sixth-generation warfare. Modern missile proliferation requires a continuous flow of microelectronics, and global smuggling networks help Moscow maintain access to this Western technology. Furthermore, for years the Kremlin has operated a range of front and shell companies and fraudulent end-user licenses to procure illicit components from Europe and the Americas.

Hong Kong is a critical hub for Russian microelectronics supply networks. With Western sanctions becoming more restrictive, China has become a key supplier of advanced weapons system components, such as machine tools, ball bearings, and semiconductors. Customs data shows that Beijing has supplied Moscow with over $300 million worth of dual-use items, which can be used to manufacture various weapons, each month. In 2023 alone, China accounted for 90 percent of Russian imports of goods that fall under the Group of Seven’s high priority export control list. For decades, Russia’s defense technological and industrial base (DTIB), like the country’s other industries, has depended on foreign supplies to maintain machine tools. Since Russia’s invasion of Ukraine, machine tools alone have accounted for almost 40 percent of the annual rise in Chinese dual-use exports, even according to China’s dubious official statistics. Moreover, commercially available drones like Chinese DJI quadcopters have performed critical military tasks for Russia’s combat formations, ranging from intelligence, surveillance, target acquisition, and reconnaissance (ISTAR) missions to spotting artillery strikes and conducting battle damage assessments following large-scale salvos.

China’s growing exports to Russia of nitrocellulose, a dual-use material needed to produce ammunition, are another important issue. Beijing exported slightly over 700 tons of nitrocellulose to Russia in 2022, but in 2023 it provided Russia with over 1,300 tons of the material.

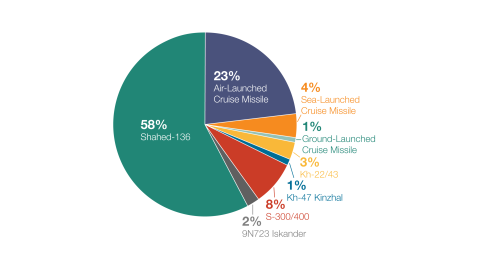

Iran is another critical member of the axis challenging NATO. Russia has launched Iran-supplied Shahed-baseline loitering munitions in strike packages alongside a variety of other offensive weapons, including hypersonic aeroballistic missiles, cruise missiles, and ballistic missiles. Iranian loitering munitions have been tested against a wide array of defensive assets, including the Ukrainian military’s Western and Soviet-era SAM systems and EW tools. By early 2023, nearly 60 percent of Russian strike packages featured Iranian drones (see figure 2).

Figure 2. Russian Strike Packages between April 2023 and June 2023

Source: Center for Strategic and International Studies.

Russia is pounding Ukraine with a diverse array of Shaheds—including the Shahed-238 jet-powered variant, a Shahed-136 variant that comes equipped with tungsten balls and fragmented shrapnel warheads, a Shahed-136 variant with a thermobaric warhead, and newer Shaheds featuring special coatings that decrease the drones’ radar signatures. Recently, a more advanced Iranian loitering munitions type, the Arash baseline, made it to the front lines. Apart from drones, Iran has also supplied Russia with tactical ballistic missiles derived from Tehran’s Fateh-110 model.

North Korea is also a critical supplier of the Russian war machine. Pyongyang, which has provided Moscow with a multitude of artillery shells and ballistic missiles, is estimated to have shipped thousands of containers to Russia since Putin’s summit with North Korean leader Kim Jong Un in September 2023. Together, these containers can accommodate 500,000 122mm-class rockets or 3 million 152mm Soviet-era artillery shells. South Korean intelligence reports that Pyongyang has ramped up its defense industry’s activity in order to supply Russia’s invasion.

Analyzing Changes in Russia’s Doctrinal Order of Battle

Russia’s Western Military District (WMD) long formed the backbone of the country’s NATO-facing forces. The WMD included the 1st Guards Tank Army, the 6th and 20th Combined Arms Armies, the 6th Air and Air Defense Army, the Baltic Fleet, and the 11th Army Corps. A robust force of airborne troops (VDV), comprising one air assault and two airborne divisions, supported the WMD.

But in early 2024, in response to Finland’s accession to NATO, Putin ordered the reestablishment of the Leningrad and Moscow Military Districts, replacing the WMD. Simultaneously, the Southern Military District was expanded to include occupied Ukrainian territory, while the Northern Fleet lost its status as an independent military district. The formation of the Leningrad Military District, which will coordinate the Northern Fleet’s ground combat formations, signals the Kremlin’s strategic intentions to muscle up for potential operations in the Baltic theater.

Geographically, the bulk of NATO’s military prowess, save for Poland and Türkiye, is based in Western Europe or North America. While US European Command deployed some combat formations to NATO’s east after Russia’s invasion of Ukraine, the alliance’s center of gravity is still in the west. Moreover, the Baltic states’ sole land connection to the rest of NATO-allied Europe is the Suwałki Gap, a narrow corridor sandwiched between the Russian oblast of Kaliningrad and Belarus. Should the Russian military block the Suwałki Gap and establish a link between Belarus and Kaliningrad, the Baltic states would be geographically isolated from their NATO allies. This would greatly complicate NATO’s ability to introduce reinforcements, maintain supply routes, and deploy follow-on forces in the event of hostilities.

The Baltic states can draw critical lessons from Russia’s 2008 invasion of Georgia. By August 2008, the Georgian Armed Forces, due to then President Mikheil Saakashvili’s ambitious reform program and Tbilisi’s growing ties with NATO member states, had become a small but credible force of 22,000 fighters. It boasted five infantry brigades with more than 3,000 personnel each, one artillery brigade, one engineering brigade, and six independent battalions, including one tank battalion with dozens of T-72 variants. The Georgian army of 2008 was a stronger fighting force than those of the Baltic states of 2024. Yet Russia’s 58th Army, 4th Air and Air Defense Army, and 7th and 76th Air Assault Divisions took advantage of favorable force-on-force and force-to-terrain ratios to overwhelm Georgian forces within days.

Russia’s military is also stronger today than it was in 2008, and the land component of the Kremlin’s military presence in Kaliningrad is significantly more menacing. The exclave’s 11th Army Corps and, reportedly, at least one battalion of the 336th Guards Naval Infantry Brigade have fought in Ukraine. Nonetheless, Russian missile forces, VKS elements, and naval assets in Kaliningrad remain mostly intact.

This is important to note because naval warfare in the Baltic Sea presents a tricky military calculus. In force-on-force comparisons, the Russian Navy does not have a clear advantage. Long-range strike capabilities, however, could favor the Kremlin. Additionally, although the Baltic Sea’s shallow depths restrict the types of submarines that can be employed successfully in combat operations, the submarine threat cannot be neglected. The Baltic Sea’s seasonal ice cover, layered waters, variable depths, and copious noise make it a suitable hiding spot for smaller submarines. Previous studies found important shortcomings in NATO’s anti-submarine capabilities in the Baltics, although these studies were done years before the Swedish and Finnish accession to NATO.

Should war come to the Baltic, Gotland, a geopolitically critical Swedish island in the Baltic Sea, could become a flashpoint. War games following the Russian invasion of Crimea in 2014 suggested that Gotland could play a vital role in regional combat operations; in one scenario, a move against the island preceded the main Russian military effort against the Baltic states. If the Kremlin deploys anti-access/area denial (A2/AD) systems in Gotland, which is not far from Kaliningrad, supplying NATO and Baltic states militaries might prove risky and highly attritional.

Another critical flashpoint to monitor is Svalbard, a Norwegian archipelago hundreds of miles away from mainland Norway. With few residents, one-fifth of whom are Russian, the island chain has been demilitarized for decades under the terms of the 1920 Svalbard Treaty. NATO members have been politically divided on how to react if Russia tests allied resolve in Svalbard. This disunity all but encourages the Kremlin’s hostile machinations.

Since 2005, the Russian military has ramped up its activity in the European Arctic. Here Svalbard looms large, as it falls within the Russian Northern Fleet’s area of interest. Since the Russian invasion of Ukraine, the archipelago has been the crux of tensions between Norway and Russia.

Nuclear Shielding, Belarus, and Tactical Nukes

Nuclear capabilities underlie any consideration of potential conflict between Russia and NATO.

Two considerations inform Russia’s nuclear calculus in the event of war against NATO. The first is nuclear shielding, which is when a nation hides behind its nuclear arsenal to pursue conventional aggression. Since the outset of its full-scale invasion of Ukraine, the Kremlin has placed the Russian military on a nuclear-war footing to threaten the West. Just days after the invasion, Putin placed Russia’s strategic forces on high combat alert. In October 2023, Russia drilled its nuclear warning system, conducting a war game centered on a highly destructive, strategic-level nuclear exchange. Moscow then deployed tactical nuclear assets to Belarus.

In 2023, Sergei Karaganov, the head of Russia’s Council on Foreign and Defense Policy, penned an article calling for a preemptive nuclear strike against NATO territory in Europe to halt the alliance’s support of the Ukrainian military. Dmitri Trenin, once a prominent Russian studies expert in the West and now a staunch supporter of the invasion of Ukraine, has openly endorsed the idea. There can be no doubt that Russia engages in nuclear saber-rattling to deter NATO.

The use of tactical nuclear weapons, a contingency the Western strategic community often underestimates, is the second major consideration that informs Moscow’s nuclear calculus. Russia possesses both a larger number and a greater variety of tactical nukes than NATO, and the Russian military recently drilled tactical nuclear operations in collaboration with Belarus.

By the end of 2023, Belarusian strongman Aleksandr Lukashenko announced that Moscow had completed the deployment of nuclear weapons to his nation. Russian news stories confirm that Belarus-based Iskander-M tactical ballistic missiles are capable of conducting nuclear strikes. Along with the Iskanders, Su-25 attack aircraft and Su-24 frontline bombers form Russia’s forward-deployed tactical nuclear delivery force in Belarus. Moreover, Minsk has also been hosting Russian MiG-31K interceptor aircraft, certified to carry nuclear-capable Kinzhal hypersonic missiles, the aeroballistic variant of the Iskander baseline.

As NATO’s 2023 Vilnius Summit Communiqué implies, the presence of the pro-Kremlin Wagner private military company in Belarus has become a security challenge for Europe and looms large in Poland’s national defense plans. Even after former Wagner leader Yevgeny Prigozhin’s botched mutiny, a small contingent of Wagner contractors stayed in Belarus to train that country’s military. In the coming years, the Russian Armed Forces will likely subsume their Belarusian counterparts.

In light of Russia’s invasion of Ukraine and its officially announced deployment of tactical nuclear weapons to Belarus, NATO member states should abandon the 1997 NATO-Russia Founding Act and extend the alliance’s nuclear burden sharing to its easternmost nations. Poland could take the lead. Extending allied burden sharing eastward would boost the West’s tactical nuclear posture against the Kremlin’s escalatory saber-rattling. Rather than permanent basing, certifying the forthcoming F-35As intended for Poland with B-61 tactical nuclear bomb deliveries would safeguard Polish airbases from being high-priority targets of Russian missile salvos.

Moscow’s Weak Spot: What Happened in Chechnya Still Haunts the Russian Military

Decades later, Russia’s wars in Chechnya during the 1990s still inform the Kremlin’s military planning. Flawed prewar intelligence assessments hamstrung Russian forces prior to their 1994 incursion into the Chechen capital of Grozny, much like they did in Russia’s 2022 foray toward the Ukrainian capital of Kyiv.

In December 1994, Russian servicemen entering Grozny were not briefed about the prospect of hard fighting there. Moscow calculated that Chechen forces—organized during the collapse of the Soviet empire by Dzhokhar Dudayev, a dissident air force general pursuing independence for his nation—were a hodgepodge rebel band. Russian military planners assumed that the mere presence of tanks on Chechen streets would squelch the uprising. Instead, the campaign ended with a Chechen victory.

The Kremlin’s reviews of the defeat emphasized three faults: inadequate training at the unit and individual levels, poor logistics that hampered large-scale operational deployment, and insufficient planning at the leadership level.

These failures still haunt the Russian military and offer critical lessons for NATO leaders as they plan for the possibility of war with Moscow.

Part 2: Mapping NATO’s Requirements for a More Robust Military Posture

At the 2014 Wales summit, NATO leaders agreed to implement a Readiness Action Plan to rapidly respond to the new security challenge presented by Russia’s seizure of Crimea. At the 2016 Warsaw summit, alliance leaders introduced the Enhanced Forward Presence, a forward-deployed military force to bolster the eastern part of the alliance, alongside a Tailored Forward Presence for Southern Europe. In July 2017, implementing decisions made in Warsaw, NATO deployed multinational battle groups to Estonia, Latvia, Lithuania, and Poland.

Following Russia’s full-scale invasion of Ukraine, NATO further boosted its strategic posture on its eastern edge, for the first time deploying the high-readiness elements of the NATO Response Force for deterrence and defense roles. At its 2022 Brussels summit, alliance leaders agreed to establish four additional multinational battle groups in Bulgaria, Hungary, Romania, and Slovakia. Subsequently, at its 2022 Madrid summit, NATO finally agreed to scale up its forward-deployed, battalion-sized battle groups to brigade level where and when required. Subsequently, the alliance has replaced its response force with a new structure, NATO Force Model (NFM), which is larger but still has important gaps. Below are the two main areas NATO needs to improve upon to reestablish superiority over the Armed Forces of the Russian Federation.

Vulnerability One: Defense Industrial Shortcomings

To understand the defense-industrial deficiencies that worry NATO planners, analysts should focus on the mismatch between the alliance’s military spending goals and achievements. The 2014 Allied Defense Investment Plan committed alliance member states to spending 2 percent of GDP on defense and 20 percent of their overall military budget on modernization programs. But in 2014, only three member states met these required military expenditure criteria.

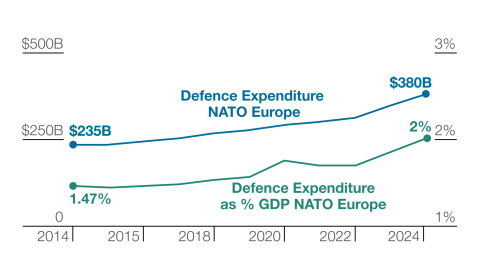

So, in 2023, the Vilnius summit established the 2 percent benchmark as a bare minimum for allies to meet—a minimum that, in 2024, 18 nations are expected to reach. Recently, NATO updated this expectation to 23 allied states. This year will also be the first year that combined European defense expenditures will reach 2 percent of European GDP (see figure 3). In 2014, combined European defense spending was only 1.47 percent of GDP, for a total of only $235 billion; in 2024, Europe will spend $380 billion on defense.

Figure 3. European NATO’s Defense Expenditure as a Percent of GDP

Source: NATO.

Note: Numbers for 2024 are an estimate.

It might appear that NATO’s combined strength would overpower its adversaries. In fiscal year 2024, the United States will spend $841.4 billion on its Department of Defense, $32.4 billion on national security programs within the Department of Energy, and $438 million on other defense-related activities in the National Defense Authorization Act. But the West’s challenges are greater than they appear at first blush.

Russia’s invasion of Ukraine, spiraling conflict in the Middle East, and China’s threat to Taiwan illustrate that the peace dividend era is over, as the United Kingdom’s defense secretary noted. Still, the West runs a defense industry built for peacetime. War games have shown that if a large-scale conflict were to erupt in Europe, the UK would exhaust its existing arsenal in a little over one week. Germany would be out of ammunition in a few days—or, in a war with a quick operational tempo, in a few hours.

On the other hand, Russia’s conventional military strength is its ability to mass artillery firepower, field heavy armor in large numbers, wage EW, engineer deep and layered defenses, continually replenish its fighting forces from a deep manpower pool, and field SAM systems against a given axis of advance. The Russian military can fight grinding wars of attrition and weather mounting casualties. Most NATO militaries and defense industries are not designed to face such a threat.

Over the course of their war, Russia and Ukraine have exchanged, on average, 200,000 artillery rounds per week. Yet European Union member states aim to produce some 160,000 artillery rounds per month, amounting to 2 million rounds annually, in 2025. The US fares only slightly better: it produced 28,000 155mm rounds per month in 2023. Washington aims to boost its manufacturing capacity to 100,000 rounds per month, or 1.2 million shells annually, but even this improved effort would not match Russia’s production level. Worse, while political will is firm across NATO capitals, revitalizing post–Cold War defense industries is not a quick task. Germany’s Rheinmetall, for example, will not be able to produce 1.1 million 155mm artillery shells per year until 2027.

In a promising step, the US Department of Defense and the European Commission published their first defense industry strategies in 2024. The US and the EU, however, have not strategically prioritized transatlantic defense industry capabilities. Many analysts suggest that both Washington and Brussels have tilted toward protectionism, a trend even more explicit in Europe, where member states are encouraged to procure from European industry, a practice that disadvantages American, British, and other non-EU suppliers.

There are exceptions to this trend, most prominently Poland, which buys American and South Korean weapons. Yet it would be very hazardous for NATO if the European and US defense industries decided to go their separate ways.

Vulnerability Two: Mass and Command Structure

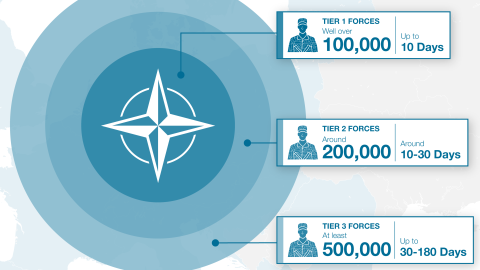

At its 2022 Madrid summit, member nations agreed to transition the 40,000-strong NATO Response Force (NRF) into the NATO Force Model (NFM). The NFM’s doctrinal order of battle, rooted in a three tiered system of force generation, is designed to boost deterrence and defense capacity by generating a larger manpower pool using rapid combat deployment. Under the new NFM, the alliance can generate three layers of deployment between 10 and 180 days from the initiation of hostilities, reducing the NRF’s 15-day response time by 5 days (see figure 4).

Figure 4. NATO Force Model Deployment Tiers

Source: NATO.

On paper, the NFM provides a pragmatic solution to NATO’s vulnerabilities against possible Russian aggression. In practice, however, the force model has three main weaknesses. First, European nations generally lack the critical enablers to sustain large-scale combat deployment, particularly in integrated air and missile defense. Russia’s war in Ukraine has demonstrated how a prolonged conflict can quickly deplete existing stocks of interceptors, loitering munitions, and combat drones.

Second, NATO has never pulled off such a large-scale deployment to date. The peak of the alliance’s Afghanistan mission involved roughly 130,000 troops, including personnel from partner nations. Assembling 500,000 warfighters as soon as one month after the start of hostilities would be, at best, challenging for NATO. Levying multiple armies, deploying vast numbers of soldiers and platforms overseas at high readiness levels, and ensuring logistical continuities in a high-tempo war are challenges most allied nations have never faced.

Third, any unit is only as effective as its command structure. At present, NATO’s command structure is centered on two strategic military commands: Allied Command Operations (ACO) in Mons, Belgium, and Allied Command Transformation (ACT) in Norfolk, Virginia. These strategic commands are supported by three operational commands: Joint Force Command Brunssum in the Netherlands, which focuses on NATO’s east; Joint Force Command Naples, which is responsible for the south; and Joint Force Command Norfolk, which focuses on the North Atlantic sea-lanes. Three tactical commands complete NATO’s command structure: Allied Air Command in Ramstein, Germany; Allied Land Command in Izmir, Türkiye; and Allied Maritime Command in Northwood, UK. The practical problem with this command structure is that it is designed for peacetime rather than wartime.

Worse, the ability of NATO’s strategic commands in Mons and Norfolk to run adequate verification in the third, largest tier of the NFM is highly questionable. While snap exercises and surprise inspections could accomplish this task, allied nations are generally reluctant to pursue such procedures.

Moreover, with Finland and Sweden becoming the newest alliance members, the Nordic and Baltic structures have to be revisited. Experts suggest that the alliance should make the most of Finland’s and Sweden’s accessions by establishing a new joint force command, JFC North. According to this view, the Nordic nations—with 360,000 active and reserve forces, 290 naval assets, 250 aerial combat craft, and thousands of pieces of heavy armor—offer considerable opportunities for NATO planners.

Analysts have also proposed the creation of a JFC East, preferably in Poland, to address the area of the alliance most likely to see Russian aggression. Geography often remains the most critical consideration compelling NATO’s strategic calculus. For example, the Estonian town of Narva, a possible location of a Russian invasion, is roughly 1,367 miles from JFC Brunssum.

But command structure is not NATO’s only challenge; two other problems test the alliance. The first is bureaucratic. If hostilities arise, Allied Command Operations (ACO) can only activate the allied force structure and put the plans in motion with the approval of the North Atlantic Council, a hurdle that could give a cunning adversary critical time to maneuver. As the head of ACO, the supreme allied commander Europe (SACEUR) needs more flexibility to place the alliance on a wartime footing.

NATO’s second additional challenge is a military one. In conventional warfare, retaking territory in a counteroffensive is far more difficult than holding and defending it. A Russian invasion, even a temporary one, is not something the NATO allies can shrug off—and the consequences for the people caught in the occupied territory would be tremendous.

The small Baltic states, seeing the tragedy in Ukraine, rightfully feel the greatest threat. In 2024, Hudson Institute dispatched a field study mission to Ukraine. The Hudson team meticulously assessed the areas of the country that spent significant time under Russian control before liberation. Our findings were clear: places like Bucha and Irpin held mass graves and a traumatized society. The Russian military committed ethnic cleansing in these towns within 80 days of its full-scale invasion.

One cannot rule out that Russia would do the same thing again should it ever take the Baltic states. War-gaming efforts by Western think tanks have shown that the Russian military is capable of reaching the outskirts of Tallinn and Riga within 60 hours. As Estonian Prime Minister Kaja Kallas has stated, even a short-lived invasion of any Baltic nation could wipe that country from the face of the earth forever. Taking back captured territory in the Baltics, which would require maintaining air superiority, is a much more difficult option than never relinquishing that territory in the first place. The Ukrainian military’s failed summer 2023 counteroffensive confirms this assessment.

Ukraine’s struggles have also revealed the weaknesses of Enhanced Forward Presence. The alliance’s new force model, therefore, should be more than a larger version of Enhanced Forward Presence. It should mark a firm transition from deterrence by punishment to deterrence by denial, which aims to deter an adversary by delaying or denying aggression. NATO needs forward defense, not merely a forward military presence.

Unfortunately, most European NATO nations, with the notable exceptions of the UK, France, Poland, and Türkiye, lack large combat formations that can sustain a prolonged war against Russia after an Article V–triggering attack against an alliance member. The war in Ukraine has shown that mass matters in war. Intensive artillery salvos, large combat formations, and armored assaults are now accompanied on contemporary battlefields by drone warfare assets and satellite internet–driven command and control capabilities.

Moreover, the ability to roll back Russian conventional combat formations in Europe would require achieving air superiority, if not supremacy, at the outset of any conflict. In 2023 alone, NATO air forces across Europe scrambled over 300 times to intercept VKV aircraft approaching alliance territory. According to NATO sources, most of these intercepts occurred over the Baltic Sea. The alliance has standing air-policing missions that call for allied nations’ combat aircraft to scramble when Russia breaches its airspace. Last, European air forces need to be able to suppress Russian SAM systems without a significant American air campaign to support them. To accomplish this goal, European air forces need to increase their supplies of anti-radiation missiles and other long-range solutions.

Conclusion

Studying the warfighting capacities of NATO and Russia is challenging while a clash between the two powers remains hypothetical. Still, it appears that while the Russian military may currently hold the upper hand in a blitz-style limited conflict against NATO, the alliance enjoys overall superiority over the Kremlin.

NATO has superiority over Russia in most emerging technologies, cumulative defense spending, and total manpower. Moscow, however, enjoys the upper hand in two key areas. First, the Russian military has local superiority over NATO’s forward presence in Eastern Europe. The alliance’s limited forward defense capacity and challenges with mobility and large-scale deployment, moreover, offer opportunities for the Kremlin to make gains in any offensive action.

Second, Russia’s defense industry and military have adapted to years of attritional conflict and high-tempo combat operations while sustaining thousands of casualties per month. As a result, NATO is bringing new urgency to its efforts to ensure deterrence by denial against potential Russian aggression. Whether the alliance can field a fighting force at scale in a prolonged setting remains to be seen.