No modern army could last a minute without microelectronics: no radio, no sensor, no targeting system would function without silicon chips. No civilian economy could function either – just look at what you’re reading this article on. Yet the US has never secured its supply line of the essential microelectronic building block, the semiconductor. That has to change.

Recent events continue to underscore semiconductors’ central role in U.S. economic and national security. Carmakers are slowing their assembly lines due to a microprocessor shortage. Export controls on U.S.-built chip manufacturing equipment and design tools helped cut Huawei’s 2020 smart phone sales by 40 percent. And the world’s largest semiconductor supplier, U.S.-based Intel, stumbled in its effort to build the next generation of cutting-edge chips, leading its CEO to step down and the company to seek US government help.

Intel’s woes signal a larger trend worrying U.S. policymakers and industry leaders. Despite being home to six of the top ten semiconductor sellers, facilities in the United States only manufacture about 11 percent of the world’s chips, down from 40 percent in 1990. In response to calls for federal intervention, Congress passed legislation last year authorizing more than $50 billion in tax breaks and subsidies for chip fabrication, and in February the Biden Administration directed two new assessments of the semiconductor supply chain.

Before dropping billions of dollars on semiconductor fabrication, however, policymakers should determine the most effective places and ways to invest across the U.S. microelectronics supply ecosystem, where private funding or policy changes may be more appropriate, and where the U.S. government should accept risk. Choices like these should be informed by a coherent framework for assessing risk or opportunity and a microelectronics strategy, both of which have been missing from recent advocacy and government assessments.

A new microelectronics risk framework

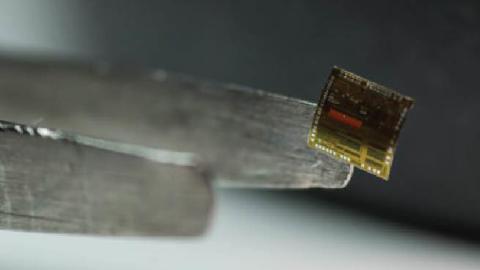

The microelectronics industry is global and complex. For example, a chip – say, a smart phone central processing unit – often starts with silicon from China, which is refined and formed into wafers by factories in Japan, imprinted by a foundry in Taiwan with integrated circuits designed using U.S.-built software tools, then tested and packaged by third-party provider in Malaysia.

That’s the simplified version. Each link in the microelectronics supply chain actually includes multiple steps in separate locations and relies on materials, equipment, and software from a growing array of contributors. Instead of a chain, it is more like a supply ecosystem. And as with any ecosystem, the microelectronics industry’s participants, including its financiers and customers, share a complex web of interrelationships. In its efforts to strengthen the ecosystem, the U.S. government should exploit these interactions to reveal new opportunities for improvement, gain leverage for federal investments, and identify emerging challenges earlier.

Perhaps most importantly, the U.S. government is a small player in the microelectronics supply ecosystem. Policymakers will therefore need to embrace market forces as part of a framework for assessing risk and opportunities, which should include the following metrics:

* Assurance: the likelihood that security vulnerabilities could be introduced into a component without being detected by in-process or subsequent validation and verification testing;

* Resilience: the likelihood an element of the ecosystem could be lost due to financial failure, physical attack, or political action;

* Value added: the element’s impact on the price or performance of the microsystem, which could led to that element having an outsized importance; and

* Demand: the level of customer interest in an element’s unique contributions, which could provide an opportunity to leverage commercial funding.

Toward a U.S. microelectronics strategy

A framework comprising assurance, resilience, value added, and demand suggests the government should primarily invest its own money in next generation technologies, while primarily using policy as its tool to improve the supply ecosystem for today’s microelectronics needs.

For example, the security of Taiwanese chips could be assured through multiple means, but the military threat from nearby China reduces the resilience of the Taiwan Semiconductor Manufacturing Company (TSM)C. A federally-subsidized foundry in the US, however, will not start production for three years or longer, and it may not obtain enough contracted chip manufacturing contracts to remain viable without sustained financial support. In that time, the market will continue shifting toward specialized semiconductors such as so-called 3D or heterogeneous chips with built-in deception features to prevent exploitation. These sophisticated microelectronics are not in high demand today, but they will be. U.S. policymakers could make the high capital cost and uncertain return of high-end chip fabrication acceptable for private capital by forming an investor group with the government as one of the limited partners, similar to the current model used by the U.S. intelligence community’s In-Q-Tel organization.

Unlike fabrication, U.S. companies are the leading providers of semiconductor design tools. The vulnerability of chip design to undetected exploitation should make these tools a U.S. government priority. Because design tools are in demand and have high value-added—especially as the market moves to more sophisticated chips—policies that encourage private investment are a more appropriate intervention than funding.

U.S. government action is needed to ensure the resilience and assurance of microelectronics that are fundamental to U.S. security and economic health. But throwing money at the noisiest or most obvious parts of the ecosystem is not the right answer. The government needs a strategy that funds next-generation technologies in the industry’s most impactful elements, informed by a framework that considers both market forces and technical trends. Without a more coherent approach, U.S. defense contractors, telecommunications operators, and electric utilities could join automakers in being unable to obtain reliable and secure chip supplies.

Read in Breaking Defense