How Congress Can Rebuild US Shipbuilding and Boost Maritime Security

Cofounder and CSO, Blue Water Autonomy

Principal, Cornerstone Government Affairs

President, Shipbuilders Council of America

President and CEO, StratasCorp Technologies

President and CEO, Hanwha Defense USA Inc.

Vice President, Business Development and External Relations, Austal USA

Senior Fellow and Director, Center for Defense Concepts and Technology

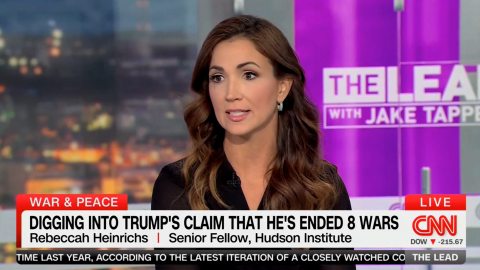

Bryan Clark is a senior fellow at Hudson Institute. He is an expert in naval operations, electronic warfare, autonomous systems, military competitions, and wargaming.

Senior Fellow, Center for Defense Concepts and Technology

Michael Roberts is a senior fellow with Hudson Institute’s Center for Defense Concepts and Technology.

For decades the United States Navy’s and Coast Guard’s fleets have been shrinking despite their increasing necessity. From the Gulf of America to the Bab-el-Mandeb Strait and beyond, US maritime forces have had to defend America and its allies with older and fewer ships and aircraft. The recently passed One Big Beautiful Bill Act will inject billions of dollars into the US shipbuilding and maritime industrial base, which can help to restore US Navy and Coast Guard capacity. But turning funding into capability will not be easy. The US maritime industry needs to address worker shortages, crumbling infrastructure, and inadequate commercial demand.

Join Hudson Senior Fellows Bryan Clark and Michael Roberts for a discussion with government and industry leaders about the challenges the US Navy and Coast Guard face amid modernization efforts and how new legislation and regulation can help restore America’s maritime superiority.

Event Transcript

This transcription is automatically generated and edited lightly for accuracy. Please excuse any errors.

Bryan Clark:

All right, well, welcome to the Hudson Institute. I’m Bryan Clark. I’m a senior fellow here at the Hudson Institute and director of the Center for Defense Concepts and Technology. And welcome, everybody, to today’s event where we’re going to focus on the maritime industrial base, shipbuilding, and how efforts on the Hill like the Ships Act, the SPEED Act and the Forged Act are all going to contribute to, we hope, an improvement in maritime industrial base, expansion of US shipbuilding, and overall advancement of US maritime security.

So, with us for this first panel, we have two panels today and for the first panel here with me, we have three experts in the maritime industry that are working actively in some very interesting areas, which I’d like to dig into in the course of this panel.

So, over on the edges here, Larry Ryder is joining us from Guam, where he’s doing useful work for the maritime industry. Larry is the Vice President For Business Development and External Relations at Austal USA, which is a shipbuilder down in Mobile. They build littoral combat ships, but more recently they build ships to the Coast Guard. They’re building T-AGOS ships or ocean surveillance ships for the US Navy. So, they’re very active, pretty varied shipbuilding company down there in mobile. So, thank you very much, Larry, for being here.

And then over here to the far left we have Austin Gray who is here from Blue Water Autonomy, where he is the co-founder and Chief Strategy Officer. Blue Water and Austal, we’ll talk more about it as we go, but they are working on a series of un-crewed surface vessels and autonomous vessels that are hoping to meet the Navy’s need for medium un-crewed surface vehicles, which we can talk more about now that that’s been released publicly.

And then last but not least, so Captain Christian Lee, retired US Coast Guard is here from Cornerstone Government Affairs where he’s a principal, but he is also an informal advisor and has worked with the Coast Guard on a number of initiatives, including most recently the Coast Guard’s Force Design 2028, which is something we’ll get into today.

So, gentlemen, thank you very much for being here today. Thank you very much, Larry, for joining us from Guam. I don’t even know how early it is there, but I don’t want to ask.

So, to get into it, the first thing I want to ask is we’ve seen with the One Big Beautiful Bill Act, the Reconciliation Act, and maybe with some of the budget that’s getting ready to be released, a lot of money going into shipbuilding in the maritime industry, in particular the Coast Guard and the Navy.

How well are we positioned as services, or they services, to take advantage of that money? How well can industry actually execute that money and translate it into hulls in the water, military capabilities, Coast Guard capabilities?

So, we’ll start with you Christian. We can talk a little bit about the Coast Guard and how well they’re positioned.

Christian Lee:

Yes, sir. Thank you very much and thank you for having me at the Hudson Institute. Really, really an honor to be here. Really, a generational moment for the Coast Guard right now with Big Beautiful Bill funding.

Coast Guard, let’s talk about orders of magnitude. I think the high water mark for Coast Guard procurement funding for ships was about $1.4 billion. They received about $14 billion specifically for ship building. So, 10 times, 10x funding for the Service. So, let’s keep that in mind.

By comparison, the Navy is typically in the $30 billion range for the SCN account, they received approximately $30 billion, right? So, it’s a lot more money, but it’s one time in terms of execution. So, keeping in mind the relative scale of that for the Service is important, but there’s no question that this is a no-fail situation for the Coast Guard. They have to rise to this moment.

The Service, as many know, has been sort of historically under invested in, and it’s piled up. And we’ll talk later about some of the structural changes to sort of meet this moment in time for the Service that they’re going through. But I think you talk to the senior leadership, you talk to folks that are charged with executing, they’re all hands on deck right now. They are running around building plans to move forward.

I mean, we learned this week that OMB is driving the Services to not even execute within the four-year window of availability for Big Beautiful Bill funds, but by the end of fiscal year ‘27. That’s two years and a month from now to execute $25 billion to a service that struggled to execute $2 billion in a year.

So, you have to come at this in a completely different way. So, they’re looking at vessel construction manager models, looking at different ways OTA authorities and other ways to execute money at scale and speed.

And then some that are maybe a little more controversial in terms of looking at options to build overseas. We saw a big announcement this week with Bollinger partnering with two finished shipyards to sort of operationalize the ICE pact. We’ll see where that goes, but I think all options are on the table for the reasons that we mentioned.

Bryan Clark:

Thanks, Christian. And then we’ll talk more about as we go through here, where is industry in terms of being prepared to execute and also what are some of these new approaches that the Services are going to have to use to be able to get their arms around executing a large amount of money in a short period of time, and doing it in a way that actually delivers product and not getting wasted.

So, I think there’s a lot of things we can do there. So, hey, Larry, I want to jump to you. So, the Navy is getting a big chunk of this money, as Christian was saying, maybe a little bit more experience and more bandwidth in terms of executing that kind of funding.

But a lot of it’s supposed to go to new platforms like the Landing Ship Medium, LSM. Some of it’s going to go to un-crewed surface vessels, and then some of it’s going to more traditional platforms.

So, how well is the Navy positioned to deliver on that and particularly its industry partners? And what are some things that they can do together to try to expand the capacity to be able to leverage this money and actually translate it into material solutions as opposed to a lot of research and development?

Larry Ryder:

Yeah, thanks, Bryan. Yeah, greatly appreciate the chance to be here this morning too. And it is early this morning here at Guam. Great place to be out here, where the fleet’s doing what the fleet we’re building is supposed to be doing. So, it’s a neat time to be out at the Naval station here and also have a foot in the door in DC, where we’re building a fleet.

As you mentioned, I think it’s an important question is, and to follow on what Christian said, it’s a lot of money for both the Coast Guard and the Navy. And we’ve got to execute it smartly. I think there’s a lot of focus on the One Big Beautiful Bill, but I also think we need to focus on the SPEED Act that’s coming in the FY ‘26 bill. I think they kind of go hand in hand. Hopefully the SPEED Act can get through quickly to provide some of the authorities and opportunities to, say, fix the process, the acquisition process a little bit.

I think you mentioned the word smart spending. I think, as Christian said, it’s a generational opportunity. We’ve got a foot in the door for both the Coast Guard work and the Navy work, so we’re seeing how this is impacting and being implanted on, executed in both services.

I think industry does have the capacity to absorb this work. I know there’s been a lot of talk about whether we need more yards, whether we need to build overseas, as Christian said. I don’t think we do. I think if we execute this program smartly, and it’s encouraging some of the discussions we’ve had with the Navy and the Coast Guard leadership that they’re open to, how do we best do this?

As you mentioned, we’ve got a short time to execute some new programs. We have to execute the LSM, and we don’t have a design lockdown yet for it. It’s a bit of a challenge. The same with the artist security cutter on the Coast Guard side.

But I think there’s ways we can expand the industrial base through strategic outsourcing. I think we’re going to talk a little bit about that, how we can flow some of this money through the larger yards to smartly build up some of the smaller, very capable yards that might have the ability to absorb Navy and Coast Guard programs directly right now, but certainly can contribute to the industrial base, much like Austal has developed over the last 25 years. We didn’t start as a prime, but we’re ready to do that now and help some of the other yards.

And then the funding provides the opportunity for long-term buys, which I think is something just about every shipbuilder and every conference has talked about for years, Bryan, that we’ve been going to. The ability to get long-term buys locked in and let the yards get the design from the Navy, take that design and go into serial production and execute.

And that’s the only way we’re going to be able to execute smartly and on the schedule that’s required with the One Big Beautiful Bill. You combine that with the SPEED Act, FoRGED, the SHIP Act and the EOs, they all can come together if we do this right and put a new fleet out there for the Navy and Coast Guard.

Bryan Clark:

Yeah, thanks, Larry. I’m glad you got the Coast Guard in there. Christian appreciates that. So, Austin, we talked about the fact that there’s some new classes of ships in this One Big Beautiful Bill act including medium use, unmanned surface vessels (MUSVs). And a lot of money going into industrial based improvements, new manufacturing techniques.

So, a fair amount of money being distributed around to kind of do shipbuilding differently than in the past. I think that’s something you guys are really focused on. How can the Navy and industry exploit the opportunity with these new classes of ships to tap into new yards and new industrial capacity?

Austin Gray:

Yeah, Bryan, it’s a great question. Thank you for having me, first. I think this is a natural follow up to what you and I talked about a few weeks ago and what Matt Pax and I were just talking about before we walked on stage. And so if we step back, at this point, the money’s there. A lot of these services owe their answers to Cape and big DoD next week to say, “This is how I’m going to spend it,” and whether they can spend it in the right way and to the parts of the industrial base where there’s slack, where it’s possible and where it’s not just R&D pouring down some sinkhole, that depends, I think, on a lot of the SPEED Act stuff and the defense acquisition and requirements reform.

And I see parts of the SPEED Act objectives every single day. I think there’s five core pillars there. It’s acquisition, requirements, regulation, industrial base and acquisition workforce. And I could have totally botched those. But each of those five, I mean I can interact with the DoD as a non-traditional vendor because they’re acquiring using OTAs very differently, right? At least for my program, the unmanned ship called The Mask, which was launched on Tuesday at the RFP. If anyone hasn’t seen it, go check it out. It’s very different than a traditional ship buying RFP.

The requirements are much simpler for this vessel. If the requirements were super complex, like our traditional naval vessel, which we build really, really sweet, exquisite traditional naval vessels. But if they were that complex, only a few yards would be able to build them, right? But instead I can go to some of the smallest but fiercest, and I think most well-fit yards in the United States, who are ready to go build some 150-foot unmanned ships.

The acquisition requirements we went through, the industrial-based money, you just talked about all the different types of money they’re going in there for manufacturing tech, for all types of equipment to be laid down at yards. The acquisition workforce is critical because every time I call the program office, they don’t have enough guys and girls to answer all of the paper that’s coming through their office and move it fast.

And the one that was in the middle that I left out there was just the general regulatory and compliance issue. We can do a lot of this with fixed price, with much simpler accounting standards and with applying, tech warrant holders can look at the cybersecurity, they can look at the explosives and the ordinance and the weapons, but not look at a lot of the other stuff on simpler ships that won’t see as much combat.

And so, they’re paring back some of those rules, and it’s letting us interact from different parts of the industrial base.

Bryan Clark:

Yeah, that’s a good point about the tech warrant holders in particular, about what kind of technical standards do we apply to these new classes of ships, and do we put the NAVSEAs of the world and the position of having to grade them on the same scale they would grade a combat ship, which tends to drive you into much more complex designs. Or even in the case of the frigate into a design that’s more like a US ship and less like a European ship, which adds cost and complexity and time to the development process.

So, let’s talk a little bit about some of these institutional reforms that we think are really important to getting the money that the Big Beautiful Bill has put in place, actually in the hands of industry and develop.

So, Christian, can you talk a little bit about Force Design 2028, what the Coast Guard is doing to make the force grow more quickly and make it able to take advantage of opportunities like the One Big Beautiful Bill?

Christian Lee:

Absolutely. Thank you, Bryan. So, Force Design ‘28, if you haven’t had a chance to read it, I encourage you to go on the Coast Guard website and take a look. It really is kind of what I referenced up front, a moment in time to meet the significance of this investment that the country is making in the Coast Guard.

Probably the largest and most banner line of the effort is this creation of the Coast Guard Secretary Service, secretary position. It hasn’t existed in our history and would be a significant change for the Service. What I believe is a very positive and needed change.

The Coast Guard, God bless us as a service, we’re really good at operating. What I love about the Coast Guard is you put us in any situation, and we’ll figure it out. I think you saw that last week or two weeks ago in Texas where a rescue swimmer on his first day in operational service brought 165 children to safety.

They actually had him up on the Hill the other night for the birthday celebration. But we’re not great in the political environment. We never have been. And it’s been kind of sporadic, I’ll say. And we struggled as a result of that. And there’s a lot of factors as to why that is.

And I think what the Coast Guard Secretary position does is sort of dedicates an individual who lives in the political space and gives that individual the man train and equip authorities that require political support, right? Man train and equip costs money and you’ve got to go find the money. You’ve got to advocate for that money in the internal White House budget process with the department and with the Hill.

We’ve always done a fairly decent job with the Hill, because people love their Coasties, and the operational successes sort of bring fans. But we’ve often struggled internally to communicate our message. The Secretary of the Homeland Security oftentimes is drawn in other directions, as you would imagine. Border security, Southwest border, FEMA, disaster recovery tend to suck up a lot of time, and the Service kind of struggles as a result of that to get the attention.

But I think you immediately saw the impact. An individual, Mr. Sean Plankey is currently serving as the senior advisor to the Secretary for Coast Guard Affairs, but he’s kind of filling that role. And I think his involvement in the process leading up to the request for the Big Beautiful Bill was critical to us getting this investment.

So, sort of the proof is in the pudding, to some degree. Now, we need to maintain that momentum. There’s language in the Coast Guard authorization bill that was passed out of the House. We’ll be conference with the Senate. I encourage those of you that are fans of the Coast Guard in here to support that going forward because I do think it’s important for their ability to execute this money, for their ability to be a better partner with industry.

And that’s sort of the accounting element of Force Design 28. It also brings back what’s old is new again to some degree, the Chief of Staff role. I lived through a period of time we call peer governance, where decisions go to die was how I used to call it. And you govern in that way, you end up with blended results, right?

So, the blended course of action always wins. And that’s not always the right choice. So, having an individual dedicated to driving decisions down instead of up, which was happening, because no one was feeling empowered to make decisions.

And then finally, this PEO structure. To me, that’s where the bigger questions are. How well do we execute really carrying out acquisition authorities at speed, at scale that’s required? They are talking and acting in ways that is very positive right now, but we’ll see. It’s a lot of money, as we mentioned up front.

And then I think the other part that’s interesting, and to my friend Austin here, gets him excited I know, is the Coast Guard is really trying to flip the script on their technology adoption approach. We love free stuff. We always have in the Coast Guard. We love to ride the wake of DoD and pick up the scraps, like a Remora, to some extent.

But they’re trying to really turn that on its head and now be the lead adopter of technology. And they’re creating a program office specifically for autonomous vessels, for man-machine interfacing, remote sensing.

And so, that’s exciting. And there’s been some investments made in Big Beautiful Bill towards that end. And the Service is really reshaping itself to move forward with that.

Bryan Clark:

So, one of the questions I was going to ask you was with the PEO structure, creating a PEO structure, would that allow Coast Guard to now do more of this acquisition in-house? Because I think a lot of times they’ve turned to the Navy to do acquisition of larger programs or other services. I mean, it seems like this would be a good way to bring it in-house and maybe at least be responsible for your own program or something.

Christian Lee:

Yeah, no, I think so. And no knock to my Navy brothers, but they’re not killing it either, right? So, somebody has to do this a little bit differently. I think both services would benefit from doing it differently, which gets back to what we talked about in the beginning. And you see the Navy talking about this VCM approach, and the Coast Guard sort of doing the same thing. So, I think both services should kind of help each other figure this out.

Bryan Clark:

So, Larry, I wanted to ask you about some of these improvements with the idea of the vessel construction manager, but more importantly how yards like yours, a tier two yard that has until recently not really been a prime very often, how are you able to expand the capacity of the shipbuilding industrial base? And what are some examples of how Austal’s done that over the past few years?

Larry Ryder:

Yeah, thanks, Bryan. I think we’re attacking it two ways. First, as we’ve done over the last 20 plus years, we’re expanding our infrastructure, our capacity, what we can do in Mobile, the ability to tap into programs like DPA, matching funds. Potentially some of these new programs come through with the Maritime Opportunity Zones and some of the other financing support programs.

They’re going to help us continue to grow. We’ve got $800 million of expansion going on right now, so that’s what we can do for ourselves. But I think the other big piece that Austal and some of the other tier one, tier two yards can do is help with building out some of the smaller yards with executing some smart strategic outsourcing.

We’ve seen the dumping large programs on good smaller yards probably isn’t the right solution. We’ve seen several failed programs that I think where we set some yards up for failure.

So, you’ve got in the Reconciliation Bill, for instance, there’s funding for a second LCU yard. How do you do that smartly? Do you go out and find a small yard and dump a new program on them? Or do you go through a larger yard and task that larger yard to mentor and grow the industrial base that way? I think those are two clear priorities.

And then you get into the other elements of the other, Reconciliation Act that where folks are focused on the shipbuilding money, as are we. I mean, the money’s great, but there’s a lot of money in there also focused on infrastructure development, advanced manufacturing, continuing some of the work of the MIB to build out the technologies, make us more efficient where it makes sense, incorporate some advanced manufacturing into the process across the industry.

We’re working on some pilot programs for the Navy now and in our yard in Mobile that we hope to successfully implement and roll out across the rest of the industry and help both address the efficiency, reduce some of the manpower requirements, because we’re all struggling with bringing the folks we need into the yard.

So, I think there’s a lot of focus on the right areas. I think, again, with the Reconciliation Bill, but also the SPEED Act combined provide the authorities to do some of these new program, our new infrastructure enhancements and increase the industrial base to absorb these programs.

Bryan Clark:

Thanks, Larry. So, Austin, I wanted to ask you about that idea, that trying to bring a lot more yards into the business, taking advantage of advanced manufacturing techniques. You guys are building an entirely new class of ship that we only really learned about the requirements for them this week, and the Navy expects to turn this around pretty quickly.

How are you going to be able to translate this RFP into hulls in the water within a couple of years? And how do you take advantage of the existing industrial base, and how do you take advantage of advanced manufacturing to do that?

Austin Gray:

So, I think that this RFP is a result of not the traditional process where companies are going to read it and then write about how they would respond to it, and then be awarded, and then go and start doing it. This is a product of newer companies like Blue Water who have gone into the building and onto the Hill and said, “We can build this right now and if you pay us, we can build a lot more of them. And regardless of what you do, we’re doing it and we’re going to keep bothering you. And we’re developing the tech.”

And you have that narrative going at a moment of national urgency to rebuild our maritime power, right? And so, then you get RFPs like the one you saw on Tuesday morning.

Bryan Clark:

So, how are you going to build these vessels? You’re going out to boatyards? Or who’s going to actually build them?

Austin Gray:

We are working with shipyards in the United States to build them. Some of the shipyards have done work for the military and for the Department of Homeland Security. Others have not. And both types of shipyards are equally excited about, I think, what we’re putting down because a tech company like us, we can do a lot of the new design, the software, build an operating system for an unmanned ship and a lot of that integration work, and connect them to the special government, highly regulated and sometimes classified environment that we come from culturally.

Bryan Clark:

And one of the things you’re focusing on, as I understand it from our previous discussions, is the autonomous operation of the hull and mechanical electrical systems, the infrastructure of the ship, if you will, whereas I think a lot of companies are focused on the automation of the control systems for it.

How has that changed your approach to working with industry to build these vessels? Since you’re looking at it from the perspective of, “How do I get the engines to run long enough and how do I get the electrical system to operate without human interference for a long period of time,” because I think normally that’s seen as an afterthought in most of these un-crewed vessels.

Austin Gray:

Yes. So, we’re focused on a full ship approach. And there are many different systems on a ship, especially on a warship. The hardware and software is very complex. And then anytime you’re taking humans off, if you’re taking people out of the engine room, if you’re taking people out of radio, or if you’re taking people off the bridge, you’re going to need some software that at the very least is doing automation.

And in some cases probably has some autonomy that can solve problems that a human’s brain would otherwise solve, because your comms pipe is not getting any wider. Right? I think we’re very lucky to have Starlink. We’re running off of Starlink right now, but we’re taking a full ship approach.

And to go back to a little more of where you were poking on the question, I can’t go into specific suppliers and I can’t talk about our power sources, but we’re working with a several OEMs who are big companies making big equipment. And we’re working with several small firms, newer ones, and old mom and pop shops in the United States. There is a lot of potential out there in the industrial base to put the pieces together for a product like this.

Bryan Clark:

Right. That makes a lot of sense. So, Christian, we talked a little bit about the Coast Guard and becoming more of a technology adoption leader as opposed to a follower. So, do you think the Coast Guard is going to be able to translate this investment, the sort of generational investment that we’re getting?

And some of the reforms that are in the SPEED Act and the Forged Act, I think will also kind of redound the benefit of the Coast Guard when it’s doing procurement. Is it going to be able to take advantage of these funding and legislative reforms to be able to speed up its ability to adopt new technologies?

Christian Lee:

Again, I go back to they don’t have a choice. And I don’t think they’re going to wait for the SPEED Act or any of these acts. I mean, there are some bolstering elements in the Coast Guard Authorization bill that’s probably the law that would lead some of the authority changes that they need and feel like they need to move out quickly.

But I mean, if we’re waiting for that, we’re already behind. And frankly, if we’re not issuing RFPs or moving forward the next probably month or so, we’re already behind. So, yes and no, I guess, is the answer.

Bryan Clark:

So, one of the challenges that the Services all face is personnel and maintenance, two costs that come in down the road, and that the One Big Beautiful Bill does not give them a bunch of extra money to do readiness to pay for people, to pay for maintenance, to pay for operations.

So, they’re going to have to come up with ways to use technology to hopefully drive down those costs for how many people do I need-

Bryan Clark:

... with ways to use technology to hopefully drive down those costs for how many people do I need to operate the system, how much maintenance does it require, how can I lower that operations and sustainment costs down the road? Is the Coast Guard looking at ways to try to reduce that burden in terms of how many people you need per ship or system to manage that growth? And some of those automation technologies, are they being incorporated into the fleet now?

Christian Lee:

Again, I think the answer is kind of yes and no because at the same time that we’re growing, that we’re building out the fleet to a more modern standard, they’re also looking at growing the service by 15,000 people in the next few years. So that’s a monumental undertaking. They absolutely are efficiency focused. There was a 25% reduction to the flag core this year, which was very significant.

But any of us that live in the budget world know this is peanuts relative to the whole. So the idea of getting more efficient with what you have, but frankly from the Coast Guard, it’s growth, they need to grow to sort of meet the demands that the nation is putting on the service. And that’s a message we just haven’t effectively communicated in recent years.

So we’ve always been the one that does more with less, and it’s a little bit of now is the time to do a little bit more with more. And so Coast Guard’s always looking at efficiency. We’ve always been, in my opinion, one of the best stewards of taxpayer money. Now it’s time to sort of grow, get right, and then move forward.

Bryan Clark:

So Larry, I wanted to ask you on this question of manpower requirements or personnel requirements, maintenance, how are you at Austal looking at new designs as a way to reduce future operations and sustainment costs to try to reduce the number of people needed on a ship to reduce the amount of maintenance it requires, the cost of that maintenance? Are you looking at ways to incorporate those features into future classes of ships? Because it seems like that’s part of what the investment from the reconciliation bill would help facilitate.

Larry Ryder:

Yeah, I mean, we certainly are. It’s really the heritage of the ships we’ve been building, especially the LCS and the EPF, were based on commercial designs that we’re focused on minimizing the crewing requirements. So that’s kind of in our DNA. I think a lot of it has to be driven though by requirements and what the Navy’s willing to accept and what the Coast Guard’s willing to accept and what they’re willing to pay for upfront in order to get that savings in the past. It’s something, I think, we’ve been dealing with for years where there are opportunities to bring technologies in early in the process that we will provide a great savings down the road.

I think a lot of what we’re learning with as we develop autonomy for the incorporation into platforms, it’s what we saw, I think, with EPF 13 and the work we did there with the Navy in particular, that a lot of those technologies that we incorporated to that test bed to allow the ship to operate autonomously have been used to operate the ships with fewer people and with higher reliability by using all the technologies and systems we installed to take the crews off the ship. What they are being used for now is to reduce the crew size on the ships and also improve planning for the availabilities when the ships do come into port.

And I think the other piece is that, I think, is some potentially low-hanging fruit on it is the contracting approach for how both the Navy and the Coast Guard do their maintenance and to do it in a more sustained, forward-looking way instead of treat each availability as an individual point in time and to go into contracting structures that allow for longer-term relationships between a yard and a platform or a class of ships.

So you get that knowledge over time that allows you to better maintain the platforms for the Navy and the Coast Guard and put those ships out to sea in a higher state of readiness rather than each availability being a new adventure for a new builder that doesn’t have the history of the platform and the vessel class.

And then I think the other piece that I put out there is the growing use of advanced manufacturing to rapidly get parts into the hands of the sailors, of the crew to get the platforms fixed, to make it more efficient to make those repairs and simplify the work of the crew with extended reality, virtual reality combined with the ability to print parts on demand.

Bryan Clark:

So Larry, Austal repairs ships as well as builds them. So it’s one of the few yards that does both of those things. Have you been able to parlay the lessons from doing ship repair into the design or the detailed design and the specific configurations of the ships you’re building?

Larry Ryder:

Yeah, I think LCS is a great example of how we were able to do that. We’ve been involved in the maintenance of the littoral combat ship platform from the start. That’s part of the reason I’m out here now instead of there in DC with you today.

But with a long-running program like LCS, we were able to absolutely learn those lessons with the working with the crews and incorporate those back into the production process in the yard. And I think that goes to that relationship and contracting strategy. We were able to have the contract to do a lot of the maintenance on LCS after they were delivered, which gave us the ability to roll that back into new production because we had a long-running stable program, and LCS did become a nice stable program on the production side.

So we’re looking to do the same thing with the Coast Guard and the Offshore Patrol Cutter program that we’re working closely with the Coast Guard to get those ships fielded, convert that potentially into a block by and put a maintenance strategy in place that allows the builder and the OEM to have a long-term relationship so that we can do the same thing, learn those lessons incorporated into the production run and deliver increasingly more reliable ships as those block visor are built out.

Bryan Clark:

So thanks, Larry. So Christian, on the OPC specifically, so the reconciliation bill puts a bunch of money into Coast Guard shipbuilding. There’s been some changes in the OPC program and who’s been doing that work. And then you’ve got the Polar Security Cutter, which also moved to another shipyard. So is the Coast Guard maybe with this new PO structure going to be able to lock in requirements and make sure they’ve got a partner industry that’s able to deliver the ships at the scale that are expected?

Christian Lee:

I hope that answer is yes because they have to again. OPC, that’s a really difficult issue. For those of you familiar with it, the Coast Guard has announced the cancellation of three and four, and there’s an RFP on the street. It doesn’t necessarily say OPC, but I think everyone understands it’s OPC one and two to get finished somewhere else.

For me having sort of advocated for that program during my Coast Guard days to the Hill and so forth, it’s sad because Eastern Shipbuilding is a really good shipyard in this country, and maybe it gets to the conversation we were having earlier as far as helping tier one, tier two shipyards be successful, or excuse me, tier three, tier two shipyards be successful, but the Coast Guard, and that’s a complicated story, so no need to really go further there, but we need to be more focused on helping yards be successful rather than what oftentimes feels punitive.

I mean, this whole idea of awarding a contract to a tier three or a tier two yard, and then you pop a champagne and you’re excited, the next thing you know it’s like, “Now we’re going to hold you accountable for everything,” which is fine and important, but there’s got to be some... I think now moving forward because the funding going to these larger tier one yards, they’re filled up. And so you need the tier twos and the tier threes to step up as you mentioned.

So how does the government now change its mindset to have ownership in making them successful? Larry mentioned it, sort of that mentor-protege approach that has sort of formal connotations in the SBA cycle, but some kind of crawl-walk-run approach where we’re helping these yards be successful rather than giving them a bunch of money, and then expecting them to be perfect at executing a government project the first time.

Bryan Clark:

So should the Coast Guard look at this idea of strategic outsourcing like the Navy has where it’s going to send structures or some components of a ship to another yard to do so that they can get used to building at some scale, and then that gets sent back to the prime to get assembled into the final ship? Should the Coast Guard look at that model in addition to the Navy?

Christian Lee:

I think so. I mean, I have the privilege of working with Master Boat Builders, a small yard in Louisiana, or excuse me, Southern Alabama. And so Garrett’s in my head right now saying, “You can’t do it that way. Shipyards build a certain way.” But I do think necessity sort of demands that some of this happens, but this idea of building pieces in parts of a ship in a certain yard and then having it all come together at some point, I think could be potentially flawed because yards just build ships differently. And so inevitably you’re going to fit that thing together, and it’s not going to fit that well. And it’s not that easy to, like in a house maybe, to cut drywall and make it all fit. I think that gets a lot more complicated in the ship space.

So maybe it’s a qualified yes in that where it makes sense, maybe the pilot house is built somewhere else and the hull could be built somewhere else, that might work, but sort of move cautiously there.

Bryan Clark:

So Austin, on the MASC, the Navy’s new medium uncrewed surface vessel RFP, there’s three flavors that are being asked for industry input on. So one is the small one that maybe notionally does anti-submarine warfare sensor operations, and then the middle one is going to do maybe mostly missile launching and carry around payloads like those. And there’s a large one that’s probably for larger numbers of missiles or some kind of even larger strike weapons.

Austin Gray:

Faster too.

Bryan Clark:

Right. The middle one’s faster, I guess. So the middle one’s faster than the large one. So it seems like there’s some use cases that are implied by the characteristics they’re demanding in these three different vessels. So do you see that you could have one vessel be configured to support all three of these applications? Or are we looking at three different vessels from three different builders? Is it going to create this complexity, or do we think a single builder could maybe build all three classes through some modular approach?

Austin Gray:

So it’s a good question. It’s going to be multi-award, they’re going to put multiple... I wouldn’t say multiple players in the field, but that’s sort of what they’re going to do industry-wise. I think if you step back, if you try to have one person or one designer or one shop do everything, well, we’ve tried that. We’ve tried layering all of our requirements onto one platform. We’ve tried it in all different shapes and sizes, and pretty much every decade we go through this in some way.

If we step back even more, 40 years ago, there were a small number of really large computers, before I was even born, there were mainframes, no offense.

Bryan Clark:

Yes, we’re familiar.

Austin Gray:

Today, there are 1,000 computers in this room within 20 or 30 feet of us. 20 years ago, or even when I joined the Navy, maybe 10 years ago, there were a very small number of satellites in space. They were all really big, they were a billion dollars of pop, there are for spying on our adversaries. Today there are tens of thousands of small satellites in space. They’re cheap, they’re mass producible. A lot of them are the same because productized.

Drones just happened. The air-breathing space is disaggregating just like space and computers did. The ocean is going to disaggregate. The payloads on the ocean are going to spread out onto all different types of platforms because of the potential of unmanned to shrink the average form factor size of a platform, because the moment you take humans off, you don’t have to build it around humans and add berthing and life support and galleys and all this other stuff. And so it’s going to change. And I think there’ll be many types of form factors, and there are going to be several industry players who can provide those.

Up at the space of ships as the mass program is focused on, I don’t think it’s going to be 20 different providers. It’s not going to be like what we’re seeing in small USB right now. Small USB, almost every founder of a small USB company, I’ve worked at one of them briefly, started in their garage because you can attach a motor to a surfboard, to a solar panel, to a radio, and you got yourself a small USB. And that’s why the Ukrainians could come up with it in week two of the war, and it’s super easy, and the same thing for small drones, but ships is going to be maybe five suppliers who get really good at it and are kind of the chosen ones.

Bryan Clark:

That makes sense. But yeah, I kind of figured the three different flavors that the Navy is asking for, they’re going to have to be three different designs largely for three different use cases than multiple suppliers for each of them. So you could easily get to having a half dozen, dozen suppliers, I would think, over time.

I want to make sure that the audience gets some chance to ask questions. So if you have questions, we’ve got microphones, we can come around. While they’re doing that, Larry, I wanted to ask you, so you talked about your work out there in Guam looking at maintenance and supporting maintenance for forward deployed forces. How about the idea too of forward positioning units like these MASC ships, these MASC uncrewed vessels. They’re theoretically going to be maybe not have the range or endurance or speed of their manned counterparts. So maybe we need to think about pre-positioning them. Is there the kind of space and the ability to forward deploy these forces, make them operationally useful once we build them at scale?

Larry Ryder:

Yeah, I think that’s a topic that we’ve been looking at. I don’t think it’s gotten nearly the attention it needs to is how are you going to sustain rearm, refit, repair these large numbers of drones. And that’s one of the topics we’re looking at here in Guam. Guam is uniquely situated as the westernmost point of the US, has a great natural harbor, had a history of being a Navy hub.

So I think with the growth of the drones, we were driving around the port area and actually saw one of the sail drones tied up here. So yeah, I think forward basing is going to be critical, not just with the drones, but with the ships. The Coast Guard cutters are out here, the FRCs are here in the Guam harbor. LCS are going to convert to forward deployed FDNF to Bahrain and to Japan.

So there’s got to be that tail that comes with it to how do we sustain and maximize the operational readiness of it. So I think that’s the piece that will start to get some of the attention that it deserves as we get more and more of these unmanned drones deployed. You’re going to need the ability to, like I said, rearm, refit, repair, and get them back in the game.

Bryan Clark:

Thanks, Larry. So I want to turn to the audience if we have questions there. So we’ll bring the mic around to you, and if you let us know who you are, and then ask your question. Thanks.

Hampton Dowling:

I’m Hampton Dowling. I work with Eureka Naval Craft. Just a question on requirements definition. Right now, the Coast Guard, the smaller Coast Guard cutters, they don’t satisfy mission requirements. It’s a lot of pushback from theater players and commanders. The smaller cutters are slow, they’re clunky, they’re not fast. And on the Navy side, we don’t have combatant crafts even planning in the inventory. We don’t have a way for almost 50% of the island chains where the Navy’s going to be operating. We don’t have assets that can navigate, get to where they need to go. And the Marines can’t push landing force ashore because we have LCUs that, for the most part, can’t be delivered.

So what do you do? As we go to this point of autonomy, I notice the theater commanders war games are really cautious. Let’s say if we’re going to complete autonomy, but not having crewed and uncrewed options, that may be a mission degradation if we completely rely on autonomy. So how do you resolve sort of the push to have technology and autonomy put into fleet, trying to be forward-looking, realizing this is very uncharted territory from a technology to platform standpoint, but also meet the mission requirements because our adversaries are not going down this path, putting a lot of assets in the water, and they’re looking at geography in a way that we’re not?

Bryan Clark:

Thanks for that. So I think a couple ways to look at that are, one, what do we need to do with regard to littoral operations where LCS was designed for that? So to what degree is that able to still contribute there? And then with uncrewed systems, can uncrewed vessels contribute to these littoral operations, can they help do logistics, can they help move Marines around? And if they’re going to be people involved, what’s the viability of optionally crewed vessels? Do you basically give up all the benefits of optionally or rather uncrewed if you make them optionally crewed? So a couple dimensions. So you want to talk to that question?

Christian Lee:

Yeah, no, I’m happy to. And while I think the mid-tier vessels that you’re referring to being clunky would agree with you there. The 270s, the 210s are really old ships. I do believe that the Fast Response Cutters are optimal for the mission you just described.

I had the great privilege of my career to commission the second one off the line at Bollinger, and I had a maybe less optimal experience of commissioning a 123, which for the kind of OGs in the room, you remember, I commissioned and decommissioned a ship in the same tour because it didn’t go well, but I saw what they were trying to do. And then I saw that realized in the Fast Response Cutter. And I think the Coast Guard and the theater commanders see it the same way where there’s a billion dollars in the Big Beautiful Bill just for the Fast Response Cutter. I think it was originally supposed to be 50, 58. I think we’re up to 68 or 70 now, and a lot of that is going to the Pacific theater.

So I think from a man’s standpoint, the Coast Guard from this sort of force packaging perspective is really trying to rethink how we deploy forces in those theaters by bringing Fast Response Cutters, patrol boats that are typically used to operating in the Straits of Florida or in the Northeast to Georgia’s banks and bringing them into the vast spaces of the Pacific, but pairing them with a larger ship, maybe a Navy vessel. And I think down the line, and maybe a good jump over to Austin is then also then now pairing them with unmanned systems to sort of spread that force multiplier.

Austin Gray:

Yeah. So I want to first challenge two of the assumptions that drove your question. So none of the war games are saying, let’s jump entirely to unmanned and not invest in the manned fleet. Brian’s probably the most credible person on naval war games and force design in this hemisphere. And I read all the stuff that comes out, and it never says that. It says this is a way to hopefully stay ahead on technology and to allocate resources to parts of the industrial base that have slack, and where there’s a little more going on to help out the main sort of 10 shipyards that are... if it’s 10, who are providing most of the fleet. So that’s one, the unmanned will complement the manned fleet.

And the second assumption I want to challenge is saying that our adversaries are not doing this, so they’re just putting MASC in the water is also, I think, the wrong premise to base our thinking off of. Our adversaries, the Chinese have a very robust manufacturing industrial base. The Russians actually don’t for maritime. Their shipbuilding industrial base makes ours look not that bad actually. It’s rustier. Their aircraft carrier burned down from the inside years before we did that to the Bonhomme Richard.

Every problem we have here, the Russians have it worse. They have a shrinking population, they have crazier politics. If you think our politics are bad, try the Kremlin. Every problem there is worse. The Russians last week, they blew up, I think, a mock aircraft carrier with a small USB. That’s just a small USB. They’re doing this in the Black Sea on the water.

The Chinese have five times the UUV prototyping product velocity that we do. Our Navy has been trying to get XLUUV, which is a very important program. They’ve been trying to get it right for the last couple of years. It’s going. It’s not the thing I’m focused on. It’s going. The Chinese have five of them in the water they’re testing out and iterating on already. And I could write a book about the sort of ways that the Chinese are leveraging their very robust industrial base to use and advance on unmanned. And if we let them get ahead of us, that is a self-inflicted, unnecessary wound that we can’t afford right now.

Bryan Clark:

And Larry, on your part of this question, the littoral operations, obviously LCS was designed for that, LSM was designed to support that as well. Are we going to be able to execute on these smaller combatants to be able to get them in the water to support the kinds of operations we’re discussing here like in the first island chain? Because it seems like right now that’s an area of the fleet that’s been, if anything, it’s been going backwards because the Frackit program has turned into such a mess right now.

Larry Ryder:

Yeah, well, I’d say the LCS, the indie varying LCS out here in-

Bryan Clark:

Oh, no. Hey, Larry, are you there still? Well, we lost Larry. He was going to say something really good too.

All right. So well, other questions before maybe Larry will come back on from the audience? Oh, there we go.

Adam Cole:

Hey, good morning or good afternoon, Adam Cole, I’m in the acquisition space, but here just as a interested citizen. What do you think is the real tipping point from your standpoint? I know we’ve talked about Congress, obviously a lot in the Big Beautiful Bill, a lot for shipbuilding writ large, a lot of just increasing the capacity of our public shipyards. Where do we see more signal, more just actual dollars going to autonomy as really, “Hey, we’re going to bet on that for the future”? I mean, is that kind of on the table, or are we still kind of really saying, “Hey, we got to get this man thing fixed”?

Bryan Clark:

Yeah, so that’s a good point. A lot of money in the Big Beautiful Bill to going towards traditional large crewed ship programs, but there’s money going to uncrewed. So Austin, if you could talk a little bit what’s going to the uncrewed side.

Austin Gray:

So when I pitched venture capitalists a little over a year ago, I had my chart showing how big the market was. And obviously you have to make it look really big. That’s the key, that’s the only reason. But the market for combined DOD spend on unmanned maritime tech and platforms, last fiscal year and the year before, it was like 300 mil, maybe 600 mil the next year. And it was, I think in 2027 they were supposed to procure XLUUV or LUSV and then maybe a little more XLUV money. That was the first year it hit $1 billion in 2027.

But here we are today with the Big Beautiful Bill passed and with, let’s say, other lines that should be recurring in the traditional budget process. And we’ve got 2.1 billion just for the line that I look at for unmanned ships, 1.4 for small USB, 1.6 for undersea, and many other types and colors of money where you could say there’s at least 5 billion if not more. So that’s a 5x of next year’s maybe number. So that’s where you’re seeing it for sure.

Bryan Clark:

And so one last thing I was going to ask on that is one thing the reconciliation bill does not do is put money towards readiness, so operations and maintenance personnel necessarily. So is that going to leave the services sort of at a disadvantage because they’ll buy this new forward structure and then they have to figure out how to pay for it being maintained and how to crew it or operate it?

Christian Lee:

On the Coast Guard side, they actually do make investments through... they call depot maintenance, which really is readiness. So they put about 2.2 billion, I think, across air, land, sea programs in the Coast Guard just to get right on readiness. And so the conversation is let’s not invest it and just move on. This is trying to correct from years of deferring maintenance.

I mean, you go to the Coast Guard yard in Baltimore. If anyone ever has a chance to do that, I encourage you to do so, because again, I referred to being sad the other day as it relates to OPC, but you go there and you’re even more sad because you’re looking at these 270s, a ship that I served on as an ensign in 1997, and it was old then being rehabbed for extended life in 2025. This is a ship that people that I served with then who I would consider on the older side saw get built, and here we are today. And so the maintenance of those vessels, I mean, they’re just in really bad shape. And so that investment is so needed, we have to get it right.

Bryan Clark:

And that’s good to hear because in the next panel, we’ll talk a little bit about this I’m sure, but the repair industrial base is part of the maritime industrial base, it often doesn’t get nearly as much love as the shipbuilding part of it, but obviously it’s critical to keep ships in service to their service lives and then beyond in the case of the 270. That’s a great point.

So let’s wrap it up there because we want to go to the next panel. So thank you very much, Larry Ryder, who we’ve lost hopefully is fine over in Guam and...

Bryan Clark:

... who we’ve lost hopefully is fine over in Guam. And Austin Gray from Blue Water Autonomy, and Christian Lee from Cornerstone...

Christian Lee:

Government Affairs.

Bryan Clark:

Government Affairs. I keep forgetting that.

Christian Lee:

Cornerstone’s fine.

Bryan Clark:

That’s right, Cornerstone. And retired Coast Guard captain. Thank you very much, Christian. Thank you very much, Austin. And Larry, wherever you are, we thank you as well. And thank you all for being here for the panel.

Mike Roberts:

Let’s reconvene here for the second group. Thank you all for being here. Really good discussion, Brian and that team on the first group. I’m Mike Roberts, I’m a senior fellow here at the Hudson Institute. My background is in the commercial maritime industry. And so for this panel discussion, we’re going to pivot and talk more about commercial shipbuilding. I’m sure there’s some overlap to some of the conversation we just heard. And we have experts here who can go both ways, on both the commercial and the government side of things. But on the commercial shipbuilding side, we’re in the midst of really radical changes that are underway now. Just in the past few months, we’ve had an executive order to restore American maritime dominance, trade law penalties targeting Chinese-built and Chinese-owned ships. And we have a proposed Ships Act, which, if approved, would be the most consequential maritime legislation since World War II.

And so having been involved in the commercial maritime industry for many decades, I can say that this kind of attention and support to the commercial maritime industry is something that was really unimaginable until really just two or three years ago. It’s new, it’s exciting stuff, and we’re thrilled to have a good group of folks to talk about this. And as I mentioned, also overlap with the subject matter of the first panel.

So let me do a quick introduction of our panel here, and then we’ll get into the discussion. Matt Paxton is the president of the Shipbuilders Council of America, since 2007, partner at the law firm of Adams and Reese. Matt has been a friend for many years. We worked on some projects going back to the early 2000s. So great to have Matt here. Scott Sloan, Naval Academy graduate and since 2023, the president and CEO of StratasCorp Technologies, which provide sophisticated IT services to the Navy and in particular a recent contract with the Military Sealift Command. Congratulations on that.

And then Mike Smith. The last, but certainly not least, Mike Smith, Stanford graduate who now leads Hanwha Defense Systems. As you probably know, Hanwha is a leading Korean shipbuilder that bought Philly Shipyard last year. And Mike and the Hanwha team have been very active in moving forward the American shipbuilding agenda. So it’s great to have you all here.

Thank you for being with us today and being willing to share your thoughts. Mike, I’m going to start with you. I’d like to get your thoughts on the Ships for America Act, new legislation. It’s a big comprehensive bill as many of you know, 350 pages almost. It covers issues that hit 12 different committees in the House of Representatives. So it’s urgently needed in my opinion, but the prospect of it getting all done this year as a complete bill seems somewhat unlikely. The more likely scenario, I believe is that parts of it will be added to the defense bill before the end of the year. So I’d like to get your thoughts on what your priorities would be within that bill if it can be included in the defense bill.

Mike Smith:

Yeah, Mike, thanks for having me back. It’s great to be at Hudson. Great to be amongst friends, lots of old friends too. I want to try to tie back to the last panel because I’m actually a defense guy and I do switch hit. But what we’re talking about with China is the MCF, the Military Civil Fusion policy, which allows them, you’ve seen that chart where you have 232 little red ships symbols and one little blue one. Each one signifies a hundred thousand tons. Pretty scary. So that’s a 232X advantage. Well, most of that tonnage being produced is commercial. So okay, now it’s not really a one-to-one comparison really, but the reality is if the red balloon goes up and things get hot, a lot of that capacity is going to be redirected to defense and that’s a problem. So in the U.S., how do we try to replicate that environment knowing that the larger yards are now gainfully employed and devouring their current backlog and finding challenges doing that.

We don’t have that commercial surge capacity. So what we’re looking to do is anything that’s in the SHIPS Act that tracks back to creating a stable demand signal is what I want. So one big thing like the strategic commercial fleet, if that doesn’t survive, and I haven’t read all 350 pages like Hunter probably has, but if that one thing survives and anything that ties back to creating that demand signal, that’s something that we should harvest and keep. Because what that does, and we can talk about shipyards all we want and other companies I’ve worked for with some other folks in the audience, the challenge was ensuring that the supply chain could keep up with us. It’s almost like a starving pump where if you don’t have that supply coming in, you’re actually not going to be able to do much. So what does a stable demand signal do?

Well, it gives suppliers the confidence to invest in technology and innovation, to invest capital in new facilities or expand what they have, to hire without feeling like they’re creating an overhang. So that’s really important. And if you look at a number of curves, so just demand curves, I always think sinusoidal. So shipbuilding is a long cycle business, and commercial isn’t that counterweight to that. We always look for the counterbalance, but that’s not it. Commercial kind of it’s market driven. So can the US government put in a steady demand signal that allows shipbuilders the opportunity to hire, retain their workforce, offer not just a job, but a career because you have a long stable backlog that you have complete visibility into. I mean, those are the things that we really need from the US government. So if I were to say, if I can just take one thing and see the strategic commercial fleet, that’s what we need.

Mike Roberts:

Terrific.

Matt Paxton:

Mike, if I could, obviously I align myself exactly with what Mike just said. We need that demand signal across the industrial base from the supply chain to our shipyards. The one thing I would add, the one thing the Shipbuilders Council of America has kind of spoken to the Congress about is there’s a section on ship repair in the bill that looks to how do we maintain this strategic commercial fleet? How do we maintain the MSP? How do we maintain the tanker security fleet? And there isn’t really an incentive to come back here to the US to do that ship repair. So we want to incentivize that. So ship repair is really critical on the commercial side as well as on the Navy side. We’re underutilized in the private sector for surface ship maintenance. Our yards are dealing with a shrinking fleet, and we need those maintenance dollars and we need that work.

So that’s the one thing I’d say on the SHIPS Act. We need to improve that kind of demand signal for the ship repair. I agree we need that 250 strategic commercial fleet. We need a maritime security board, very much a national maritime strategy. We don’t have that. We really need that. And I think what you saw from the administration with your executive order, they agree with that. They think a national maritime strategy, a maritime action plan, whatever you want to call it, is critical. So if that could get into the NDA as well, that would be critical. And the last thing I’ll say, we’re building 250 ships. What’s the demand side of this equation? What are we going to put on those ships? And we got to be thinking about that. So there’s a piece of the SHIPS Act called the Energizing American Shipbuilding Act that we’ve worked on for years with Garamendi and Senator Wicker’s office.

We should have that piece of legislation go. It should have happened when we lifted the oil embargo. We should have had something for that. The Energizing American Shipbuilding Act just says a certain amount of our LNG, a certain amount of our crew is going to go on US built LNG carriers, US tankers. So that demand side signal is really critical. So I want to see the SHIPS Act move. I mean, there’s a lot of things in there that are really critical, but when you get referred to 12 committees, that’s tough. You got referred to two in the Senate, the Commerce committee and the finance committee. That was the smart move. But it’s going to take a lot of work. You’re going to hear this over and over again from this panel. The demand side signal is absolutely critical. And if our top tier yards are chock-full with Navy work, we have a lot of mid-tier and lower yards that are ready to step up.

One last fact I’ll throw out at this group, we have 154 active shipyards. That’s undeniable. And so you heard Austin talking about this, there’s a lot of shipyards that can get into this autonomous space that otherwise wouldn’t be playing in the game. But WorkBoat came out with their survey last year, and in 2024, we delivered 925 vessels. Now, not all of those were big blue water vessels. That includes Navy, that includes Coast Guard, includes all the commercial space. Why I bring that stat up is that we are an industrial base that’s here. We are an industrial base that wants to continue to grow. And the investments you see going on in Hanwha Philly, but across our shipyard space is in the order of billions. We are stepping up. The shipyard industry is investing here, and they’re making long-term investments in our facilities, in our workforce. So I can’t say enough that we have an industrial base that’s here. So let’s use it.

Mike Smith:

I agree with you, but I’ll also say, I mean the Navy’s concept of a regional sustainment framework, understanding the size and scale of the Pacific really means we have to have a capability to do some of this work forward. We have to because it’s about on-station time, and it’d be quite challenging to bring ships back to, well, it could be Guam, it could be Hawaii, or all the way back to San Diego. So what I want to look for, are there partnerships with the VIGORs, the BAE, the NASSCOs of the world to work with folks farther into the Pacific to enable that capability to have that forward.

Mike Roberts:

So let me jump in here. I think it’s a good point. A good question. May not be 100% agreement on that particular point, but I think it’s worth bringing up. Before I riff off of that further, I want to bring Scott into the conversation. Scott, your thoughts on the SHIPS Act and anything that may be particularly important from your perspective.

Scott Sloan:

Agree with these two guys for sure. You got to have the leadership, and you got to have the Maritime security board, Maritime security advisor, the executive order created the office of Shipbuilding, however that sorts out. I think you got to have that person with the seat at the table because nothing else happens. It doesn’t get the attention, doesn’t really get the time of day or the sunlight that it needs without it. Strategic Sealift capability from Napoleon to Barbarossa to Japan and the Pacific, everything depends on logistics and supply. And so without that... And I think that strategic Sealift can also to these guys’ points is really help with that demand signal long term and get it to a more stable level to impact the market. But what I’d also talk about is the efforts for workforce development, workforce improvement, workforce expansion. We not only have to build the ships, we have to crew the ships and everything like that. So there’s a lot of work there.

Mike Roberts:

Might go ahead, continue on that. There’s a lot in the bill about workforce development. The first tier yards in particular, most yards have been challenged with workforce development, first tier yards in particular to recruit, train, and retain the qualified workforce large enough to meet the existing ship orders. Some have made the suggestion that growing the commercial shipbuilding industry will make that problem worse. That will just spread the existing workforce over a broader base. What are your thoughts on that?

Scott Sloan:

Well, we can’t not do hard things and long-term things because we have short-term problems, right? So will there be near term interference? I think there probably will be. But I think the bill as well as some of the DOD folks with Maritime industrial based project, I mean, they’ve really put a lot of effort into expanding and growing who that is and what that industry base looks like. I think we also have to be open on our side with industry about how we do that work. So it’s not about just more people, it’s about more productive people, and how do we get advanced technologies into our shipyards that just allows more throughput to go through.

The other part that I would say is that, and I think they mentioned it on the previous panel too, I mean, there are, I think portions of our workforce, especially in middle America that are completely untapped and raising their hand and ready to come to the fight. And whether you call it modular construction or how you fit that supply chain together is really, really important. But I think there are ways that we really need to look into so that we can really use all of America to come and fight the problem.

Mike Roberts:

That’s how we get a senator from Indiana as one of the lead sponsors on this maritime bill. That’s good. Mike, your thoughts?

Mike Smith:

Along the lines of what you just said. I mean, Jerry Hendricks over at OMB, who’s a big proponent of ours. I mean, he’s done a lot of work in Michigan. So how can you use the Rust Belt and augment our shallow pools down on the Gulf region to help augment our ability to output or increase throughput?

Yeah, it’s interesting. So we had a couple of guests up in our yard yesterday. And one question was, okay, since you’ve closed on Philly, you guys have grown from 1200 people to over 1800 people. So that’s been about seven months, almost eight months. And where are you getting these people from? And so while we’re drawing from a tri-state area, from Jersey, from New Castle County, Delaware, from Southeast PA, folks are coming from the construction industry or other production-oriented segments of the economy. And the reason why they’re coming, and I’m going to say demand signal like 50 times today. So it’s because they see a future in shipbuilding. And at some point they may decide to get into Navy shipbuilding, and they’re going to see their ability to go back and forth. In fact, in Philly, we might be doing some Navy shipbuilding as well.

So the ability to bring new talent in, train them up and then retain them is absolutely critical. And we’re going to be able to show them that, hey, this is a lifestyle. This is a life decision, not a job, but a long-term career. And so I’m really happy to see the investments in workforce development. It can’t all be infrastructure. You actually have to have people operate. So it’s pretty critical.

Mike Roberts:

But the demand signal, I’m going to join the chorus here, but I mean, when you talk about going from 1200 to 1800 in less than eight months, it went from under 100 to 1200 in five years.

Mike Smith:

It was nine at one point in 2008, 2009.

Mike Roberts:

And those workers didn’t come from Connecticut or Newport News, Virginia. They came from the tri-state area for the most part, right?

Mike Smith:

Some are coming from oil and gas, kind of a migratory workforce that doesn’t mind moving on and contributing in different ways. So yeah, that’s a good story.

Scott Sloan:

Well, I think the other part of that that we’ve got to work on longer term is making sure that folks in... I’ve got a son that’s getting ready to start middle school. We’ve got to get into youth education programs and not undo the last 40 years of STEM, STEM, STEM, but I think it’s a yes and strategy. There are some folks who are going to be really good at STEM. There are some folks who are going to be really good at welding and pipe fitting and coming in and doing that trade work. And to Mike’s point, these are great career decisions that are family sustaining jobs. Put one shot back in a curriculum and that sort of thing. And the SHIPS Act mentions a lot of that stuff. It calls out the Sea Cadets and other youth education programs to really drive home that message that America’s not just white collar. There are these things that we need to do and we need to bring back in so that we can fight the long term.

Mike Smith:

And it’s not just your mom and dad’s shipyard. It’s changing. And I’ll say one more thing. With Korea, we have a fractional population growth rate, which means year-on-year you have a smaller population. And so you have to bring in automation, you have to find ways to replace people with capital because you don’t have a choice. So we’re bringing over some of those automations into Philly. We’re able to move from two to three blocks per X period to six to seven blocks, and that’s again, over eight months. So folks show up. It’s not just about traditional welding. It’s, can you operate this welding robot? It’s a transforming environment. And I think that appeals a little bit more to the upcoming next few generations.

Matt Paxton:

And Mike, one last thing on workforce, certainly in certain market segments, we have workforce challenges for sure, on the higher end proficiency of building some of the most lethal stealth-capable nuclear navy assets in the world. But in other places, I don’t think there’s a workforce problem. I think there’s a contract problem. And so we want to get these things on contract. And what would be great is if we had multi-ship contracts, again, that demand signal and getting them out there, getting shipyards the work that workforce will be there. And again, some of this stuff we’re talking about is not going to be on order of complexity of some of the things we have to do for the Navy. So what you’ve seen at Hanwha Philly is the ability to ramp up and continue to sustain that because of the work that Hanwha Philly went out and hustled and got in the commercial market space and then delivered on a major government shipbuilding program, showed proficiency there.

I mean, when shipyards had that work, had that demand signal, it’s funny how they can find that workforce. And so we want to continue to do that. The other thing is the Shipbuilders Council of America is highly supportive of the talent pipelines that are out there. We want to continue to have those welding schools, those schools out there that can produce a next generation of shipbuilder and Mariners. And the ships being built at Hanwha Philly are really showing a surge at our maritime academies because they want to get on these new national security multi-mission vessels. That’s a big draw for our seafarers as well. So it’s multifaceted.

Mike Roberts:

Yeah. Great. Great. I want to shift for a minute and talk about taxpayer bang for the buck, so to speak. We discussed in the last panel the $55 billion in new money going to the Navy and Coast Guard over five years for shipbuilding in the reconciliation bill. The main driver of growth in the SHIPS Act commercial side of things would be the strategic commercial Fleet program, which is estimated to cost $11 billion over 10 years. So 55 billion over five, 11 billion over 10. It’s not necessarily an apples-to-apples comparison, but it gives you sort of a net order of magnitude understanding here. For that $11 billion over 10 years, it would close the Military Sealift gap, which we have, which is huge now. It helped reduce the vulnerability of our maritime supply chains and restore commercial shipbuilding in the United States with that consistent demand signal. This is an easy question. Is that not a good investment of taxpayer funds?

Mike Smith:

But how’s that enough money? So we’re at 80 now, roughly, we’re going to 250, so 170 ships over whatever period of time. And if you’re thinking about 200 million a copy, and we must be thinking something much smaller, you’re nowhere near. I mean, you’re now near in $30-plus billion range. So my concern would be, is that really enough money? But forget that for a second. Is it a good idea? It’s a great idea. I couldn’t endorse that or foot stomp that any harder.

Matt Paxton:

And Mike, what I would say is there’s going to be certain platforms that we’re building that are not surface combatants, don’t have the combatant systems on them. You already see this. This is happening in both the Senate, NDAA, the House NDAA, you’ve seen in the Coast Guard Bill. We’re going to have to acquire some of these assets differently. Again, I caveat that not all assets, not all platforms, but for the strategic commercial fleet, for certain other types of government shipbuilding programs, we should be doing what the Congress is saying, what this administration is saying, buy better, acquire these things to commercial best practices. Utilize a vessel construction manager where appropriate. And you can acquire these things.

I mean, in the Coast Guard bill, they say for the Arctic Security Cutter, an entity other than the Coast Guard should be acquiring these things. And that’s not a shot at the Coast Guard. I’m not taking a shot at NAVSEA. We’re all in this together. We’re all partners in this. But for certain platforms, we just got to acquire them more efficiently. And with design set, I don’t need to go down and explain the National Security Multi-Mission Vessel program to you, but they didn’t have design change. They just built the ship as designed and went forward and did it. And that’s why they’re delivering the way they’re delivering. So we got to do things in the acquisition space fundamentally different to seize this moment. Otherwise, we’re going to miss our shot.

Mike Smith:

I hate jumping in real quick, but...

Matt Paxton:

No, no, I don’t think you did.

Mike Smith:

I will say, I mean to add to that, buying things smarter, I think that’s one of the things. We talk about acquisition reform all the time, and I tend to do that when we do, because I get bored. But this is important, and I think one example, I know, I don’t know if it’s under the SAWS Act or where it sits, but if you’re a submarine builder, you’re forced to predict for non-production labor out 14 years and project that back and build that into your cost structure. By that time, that dollar has reduced down to less than 50 cents. So if you’re moving into a fixed price environment, that’s a really difficult needle to thread, no matter how smart your team is. So things like that we need to look at and audit to see if it still makes sense for this industry.

Scott Sloan: