Investing in the US-Japan Alliance: Issues and Solutions for the $550 Billion Investment Fund

Senior Fellow and Deputy Director, Japan Chair

William Chou is a senior fellow and deputy director of Hudson Institute's Japan Chair.

Head of Government Affairs, Ara

Senior Vice President of Corporate Affairs, American Honda Motor Company

Deputy Head, Global Structured Finance, SMBC

Executive Director, Keidanren USA

Director of Energy and Regulatory Policy, Mitsubishi Electric Power

Japan Chair

Kenneth R. Weinstein is the Japan Chair at Hudson Institute.

On September 4, the United States and Japan outlined the structure of the $550 billion US-Japan investment fund, and gave further insight into how Washington and Tokyo will use it to advance their industrial and technological leadership. The allies agreed to focus on several strategic sectors—including shipbuilding, critical minerals, pharmaceuticals, artificial intelligence, and energy—that will spur mutual growth, secure allied supply chains, and insulate the US, Japan, and their allies against economic coercion.

To further explore the fund and its allocation, Hudson Institute’s Japan Chair will host an event featuring two panels with financial, industrial, and policy experts. They will:

- Explain how the fund will operate and address and lingering questions about implementation.

- Identify specific strategic chokepoints that the $550 billion fund can help solve.

Event Transcript

This transcription is automatically generated and edited lightly for accuracy. Please excuse any errors.

Ken Weinstein:

Well, good afternoon and welcome to Hudson Institute. I’m Ken Weinstein, Japan Chair here at Hudson. I’d like to welcome everyone on behalf of my colleague Will Chou, the senior fellow and deputy director of the Japan Chair, for our set of panel discussions on “Investing in the US-Japan Alliance: Issues and Solutions for the $550 Billion Investment Fund.” It’s obviously a topic of some interest that we’re able to gather a crowd on a Friday afternoon in Washington, DC, at 2:00 p.m. That’s a rare panel at this hour, and so I guess there is immense interest in this topic. As we all know, on September 4, the US and Japan outlined the structure of the $550 billion US-Japan investment fund and gave further insights into how Washington and Tokyo will use the fund to advance industrial and technological leadership. The allies agreed to focus on strategic sectors, including shipbuilding, critical minerals, pharmaceuticals, AI, and energy, that will spur mutual growth, secure allied supply chains, and insulate our two countries and our allies from economic coercion.

Of course, during the very successful US-Japan summit in Tokyo . . . Is it now a week ago, two weeks ago, I can’t even remember. I know I was there for it a week ago as a number of us were. The topic came up and there were 20 potential investment programs that were discussed at the summit, totaling around $400 million in terms of potential allocations. To further explore this fund and its allocation, we’re having two panels today with financial industrial and policy experts to explain how the fund will operate and to address lingering questions about implementation and the like, as well as to help identify potential strategic choke points that the fund can help solve. The first panel will be a discussion between Will Chou, our deputy director of the Japan Chair, who needs no introduction here at Hudson Institute but I guess I’ll do one nonetheless. Will is a graduate of Yale University, did his PhD at Ohio State, has written with great insight on trade and economic issues here, previously was a scholar at the Institute for Defense Analyses and at the Ronald Reagan Foundation, among other places.

But we’ll first hear from Teruko Wada, who is the executive director of Keidanren USA. She was formerly the director of international affairs at Keidanren headquarters in Tokyo, in charge of trade economic security and building relations for Japanese businesses with the US, the EU, and Canada, and has had wide engagement with multilateral organizations, including the G-7, the G-20, OECD, and the like. She has a BA from Waseda University and LLMs from both the University of Tokyo and Georgetown. The Georgetown one, she earned as a Fulbright scholar, but most impressively, she was the chair and president of Girl Scouts of Japan for six years. I checked and Will was not an Eagle Scout unlike Bill Hagerty and a number of other members of the US Senate, so we don’t have that thing. Let me just welcome both Teruko and Will up here.

Unless someone wants to make remarks on the podium, we’ll do them seated. Okay? Great. Let me welcome you up here and looking forward. Thank you so much for being in. I want to thank the Hudson Institute events team for pulling this event together when you could be sitting at home watching whatever. Okay, thank you. Take care. Will, let me ask you to go to start with some opening comments unless you . . . Will, you want to . . .

William Chou:

Actually, if you don’t mind, I’ll just sort of just kick off with some background and then throw it over to Teruko afterwards. Thank you all so much for coming here today for this event. Obviously, I think there’s a lot of interest in the $550 billion investment fund, although I actually have some problems with that term which I’ll explain later. But just as a quick background for those of you who are interested in this issue, the $550 billion investment fund was a vital component of the July US-Japan trade deal. It was a way to reorient Japanese efforts. Essentially, during the trade negotiations, Minister Akazawa pushed for economic security as a way to address the trade negotiations between the US and Japan. At the same time though, the United States was really emphasizing FDI and industrial investments, and so the result was ultimately a $550 billion fund that was agreed to in July. With the memorandum of understanding finalized in September, although some things still remain uncertain, where this fund would be used to invest in strategically important sectors, and the fund would be also be used by the end of Trump’s term in January 2029.

The strategic sectors include semiconductors, pharmaceuticals, shipbuilding, AI data centers, energy, critical minerals, and more, and the aim is to provide a loan fund that will make possible this kind of investments, things that are strategically important but may not be commercially viable right away due to either the small size of the offtake or because of adverse economic situations that are either natural or sort of distorted. In this case, the US government will facilitate leases to federal land, water, power, and energy, whereas the Japanese government will provide the money in dollars to these projects. The United States will also expedite relevant regulatory processes and organize offtake arrangements. Japan, through the Japan Bank of International Cooperation, JBIC, will fund these projects using a mix of dollar-backed bonds, yen loans from the Japanese government, transfer of US dollars from Japan’s $1.4 trillion of dollar holdings, and loan guarantees from private firms. Of course, the exact mix and allocation of this financial support is still up in the air, and that’s something that we’re still waiting to hear more about from both Tokyo and Washington.

But given all that, and I know there’s probably going to be a lot of questions, but I would just like to make four points of emphasis regarding this deal. First of all, the whole concept of it being an investment fund is a misnomer. It really is a loan fund or a debt obligation vehicle. That is the key. When you call it an investment fund, it gives the impression that, essentially, Japan is giving the America the money and it’s never going to see it again. Rather, it’s a loan fund where the US can draw from, it would be paid back 50-50. Moreover, once the original input is paid off plus interest, Japan will continue to earn 10 percent off the profits, or dividends, or whatever of the project. Normally with a loan, once the loan is paid off, you don’t get paid anymore. In this case, Japan continues to earn 10 percent on top of that. If you frame it in that term, not as an investment fund but as a loan fund or a debt obligation vehicle, it becomes a much more compelling structure.

Second, JBIC will always look out for Japan’s interest. The agreement from September stipulated that any project that is agreed to must comply with the domestic regulations and laws of each country. By that measure, the JBIC Act asserts that all projects that JBIC funds must be bankable, aka profitable, must benefit Japanese firms or Japan either through business or offtake of, say, critical minerals, or some other kind of national security, economic security from priority. This is a way to safeguard Japan’s own interest with this fund. It will not be used to fund boondoggles. Third is the creation of the investment committee and the consultation committee, where there was basically . . . Investment committee is chaired by Secretary of Commerce Howard Lutnick. The consultation committee will consist of a number of administration officials, both within the US government and also the Japanese government. I believe there will be three, one each from the Ministry of Economics, Trade and Industry, Finance, Foreign affairs. Most importantly, I think this setup, this consultation committee, provides Japan with an opportunity to have consistent face-to-face contact with the US administration officials on a frequent basis.

This is one of the key things that is of currency within Washington, the chance to meet with principals face to face, and this is an issue that, I think, addresses some of the challenges that Japan has had in the past year, where we frequently hear at Hudson the question of, who do we talk to in this administration, how do we talk to him or her, and how do we get there? This consultation committee provides Japan with such an opportunity that, frankly, no one else will have. Finally, the investment fund, the debt obligation fund, whatever you want to call it, provides Japan a chance to invest overseas on favorable terms, both increasing its FDI overseas as well as address Japan’s economic security issues. The US has long been one of Japan’s topmost investment destinations, totaling $890 billion. Also, among Japanese firms, the US is the top choice for developed world investment destinations. With that, this fund further encourages that trend while also bolstering Japanese economic security. I think with that, I’ll just leave it there and hand it over to Teruko.

Ken Weinstein:

Okay.

Teruko Wada:

Thank you. First of all, thank you very much for inviting me to this discussion. It’s a great honor to be sitting next to Ken and also Will. Thank you for organizing this event. I will speak on behalf of Japanese businesses as a whole. Because I’m not in a government position, I cannot responsibly explain about this whole scheme, but I can only explain the impression or the feedback from the business point of view. To start with, Japanese companies, as we’ll just elaborated at the last part of his remarks, that Japan has been the number one investor to the United States for the last six consecutive years. We continue to invest and the interest and appetite to invest in the United States remains very strong. This, of course, because of the attractiveness of the market and also the strength of the US economy, but also, this shows how much Japanese businesses are committed to the US economy and the society.

The investment has spun in very diverse areas, including automobile manufacturing, pharmaceuticals, which are already a focus but still, our food industry or R&D, so our investment is already so diverse and so deeply rooted in local economies. This is not the response to this recent trend of onshoring, but this reflects a long-time commitment of Japanese businesses, and as we consider this new framework, I’m glad that we’ll correctly clarify the nature of this scheme of the framework, as this is not a fund but still a facilitation scheme to encourage investment in both countries. I think many Japanese companies are seeing this as an opportunity and I think they should see this as an opportunity, because this whole idea is to facilitate the investment, not to put an extra burden on it, and since we already have a very strong appetite to invest in the States, this framework should encourage, and facilitate, and pave the way for the businesses to smoothly move into the actual investment. W.

Hen there’s a higher risks or the higher regulatory burdens on some projects, there’s US governments who are committed to facilitate these investments, so there should be a proactive way for Japanese companies to engage. Japanese firms are particularly interested in understanding what additional benefits or incentives the framework would offer. For instance, could it help streamline regulatory processes such as permitting? Or how about the CPS review, will it expedite the process or will it give some encouragement in that process? Or could it reduce uncertainty stemming from discrepancies between federal and state regulations? Another important consideration is how the framework will interact with existing investment. As I said at the beginning, there’s already a robust investment appetite, and rather than retrofitting projects to fit the framework, is there a way to make the framework flexible enough to support initiative already underway or in advanced planning? That kind of adaptability could significantly accelerate the impact.

We also recognize that sectors identified, like semiconductors, energy, AI, critical minerals, shipbuilding, and others, they require long-term capital commitments. Japanese companies will need to carefully assess feasibility, especially in areas like shipbuilding where industrial competitiveness must be strengthened and domestic capacity constraints remain a challenge. Given shipbuilding’s strategic importance from a national security point of view, the Japanese government and the businesses are already engaged in an active discussion how to address these issues. There’s concern about whether sufficient capacity exists to expand operation in the United States quickly enough, particularly given supply chain limitations and workforce shortages are very often mentioned. Finally, the companies are watching closely to clarity on any conditions that may attach to this investment. Transparency, predictability, and sustainability of government support will be essential, so we hope this framework not only catalyzes new investment but also recognizes the decades of effort Japanese companies have made to build and maintain resilient, innovative ecosystem across the United States. We look forward to working with our American partners to ensure this initiative strengthen our shared industrial base and delivers lasting value for both economies. Thank you.

Ken Weinstein:

Thank you, Teruko. Thank you, Will. Both very helpful comments for us as we try to make sense of this $550 billion debt obligation vehicle. Both very helpful. Let me turn to you, Will. Let me just ask you about a couple of concerns that Teruko raised about, in particular, workforce capacities. Does the United States and/or Japan have enough skilled labor to handle some of these new industrial projects? I mean, we’re seeing shortfalls in terms of engineers, processing specialists. I mean, from every report I’m seeing, whether it be just anecdotal from people I know in the tech sector or in the chip manufacturing sector, we’re seeing unbelievable labor shortages in those sectors in particular. I’m wondering how you see how these concerns might be mitigated.

William Chou:

Yeah. I mean, I think the workforce issue is a huge challenge. Both Ken and I just got back from Tokyo a few weeks ago. I was there for two weeks, and this $550 billion fund was a major topic of conversation that I had, and in every circumstance, every corporate representative I’ve talked to raised a workforce issue. That’s unavoidable. It creates constraints. For instance, if we talk about AI, all the energy that you need to power all these data centers and also power the cooling systems of these data centers, all that has to be supplied by energy, and in some cases, that energy might be supplied by, say, gas turbines from Mitsubishi Heavy Industries. However, Mitsubishi Heavy Industries has said before that they are completely tapped out in capacity in terms of building more gas turbines until 2028.

A lot of that is down to a workforce challenge, and so these are ongoing concerns. I think SIA had a study that came out earlier this year that talked about how, by 2030, we are going to need 75,000 more technicians to produce and maintain all those semiconductors and data centers that we’re going to need as part of this AI push. That’s even before we expand our efforts even more, given all the announcements that we’re always hearing about more AI data centers that are being planned, and so that’s a major concern. I think the administration has tried to address them to some extent. I think there was a Department of Labor and Department of Commerce report back in August that talked about some basic principles about how to address the workforce challenge. I think the administration is aware of this, but it’s one of those things that will take time and it’ll also take a lot of cooperation on the federal, as well as the state and municipal levels.

The good news, I think, is that, one, I think Japanese companies who have been in the United States some of them for 50 years now, and certainly for 30 and 40 years, they know what it’s like to work on workforce issues because they oftentimes have trained their own workforces. This is a story that you certainly hear from Japanese automakers, as well as other Japanese electronics makers and engineering firms, so I think Japanese companies are both aware of the situation. In some cases, they’re dealing with the shortages of workforce, but they are also part of the solution. Certainly, I think going forward, any solution in terms of addressing the workforce issue has to be both a public and private partnership going forward.

Ken Weinstein:

Do you think AI has a role to play in meeting the challenge of workforce shortage?

William Chou:

Yeah. If I could just jump in on this, I think AI certainly is part of the solution. I think in the report that the administration published over the summer, it talked about how AI will help determine or help, essentially, workers find the best-suited jobs for them, create the best fits and identify the best locations where their towns can be best utilized. AI will be part of that solution, I believe, and it’s just a question of how do we deploy it most effectively.

Ken Weinstein:

Yeah, of course.

Teruko Wada:

May I add on that? Regarding the use of AI, when there is a labor-intensive industry, they need people to work, but if you don’t have enough people to work with, you have to come up with some kind of additional supplementary force to do that job, and a combination of AI and robotics could be a hint to solve the problem. If you don’t have people, you can maybe earn research and development in robotics and AI to utilize the know-how cultivated within people, can be adapted through AI and incorporate into robotics. There’s a room for American innovative intelligence to help to come up with the solution.

Ken Weinstein:

It’s clear that, this is from what I understand of AI, that we can use it to both allow grasping LLMs and other things. We can actually bring workers with very basic skills up to a much higher level of effectiveness and then there’s the robotic solution, which, interestingly, when I was in Tokyo, I heard talk about this on numerous occasions, about robotics is one of the means of dealing with the challenge of immigration in Japan. It’s sort of become a much broader policy theme of some on the right in Japan, actually, to deal with the immigration challenge, which I’m somewhat skeptical of, I have to say. Let me also ask about another issue that you raised. Let me ask Will this on the question of the regulatory challenges at federal and state level. I mean, you also talked about it. It’s a big factor on some of these investments we see. For example, in data centers, there’s some states, Indiana, Alaska, Texas, that are big on welcoming data centers. Others have more complicated regulatory regimes. If we’re trying to fast-track some of these investments, what can we do?

William Chou:

Yeah. I mean, I think this discrepancy between what the federal government is going to do under the $550 billion fund, where it’s going to provide favorable leases of federal land, and water, and energy, that’s all extreme compelling. I think this is certainly the federal government giving its political backing to these projects, and it’s very reassuring to the financial firms that I’ve talked to about this fund. However, there is also . . .

In our conversations in Tokyo, what raised came up was the fact that, yes, okay, great, we have federal support for these projects, but a lot of these projects are still going to be taking place in states possibly with quite stringent environmental or other regulatory standards, and that is something that this fund does not quite yet address. I have no doubt that as they’re trying to implement these and try and fast-track them, they will address them as part of the federal government’s larger push towards a regulatory reform. But as of now, it’s still one of those things that it’s there. It’s a concern. Certainly, we are trying to bring it up as trying to convey the concerns that Japanese firms in Tokyo, as well as in Washington, have expressed, and hopefully, going forward, there’ll be larger discussions. I know that the commerce department is in talks with Japanese firms, and hopefully, they’ll be brought up as an issue.

Teruko Wada:

Yes. We do have a concern about the regulatory discrepancies among states. That is common not just within the states, but it’s a common challenge across the borders, across the national borders. If one jurisdiction have very strict rules, the companies, they have to accommodate to the stricter rules to . . . They cannot make a business model, business products, customized to each jurisdictions. It’s better that you have the unified design of the products or the services that can be sold or provided in any jurisdictions, so definitely, the coordination between state and the federal will be very much expected.

Ken Weinstein:

Well, let me ask two more questions of you before we open it. There’s an awful lot of expertise here in the audience that would be good to hear from the audience with some questions. One of the issues which comes up, which you raised, Teruko, on your . . . Was the CFIUS question of getting sort of more predictability, more rapid decisions on the CFIUS process. We all lived through the Nippon Steel-U.S. Steel deal and saw the ridiculous claim of the Biden administration. This was a challenge to American national security, which, frankly, I think was probably the most despicable ruling out of CFIUS in that period. Is there any hope to make the process move more quickly, do you think?

Teruko Wada:

There’s a kind of strong expectation from the Japanese government and probably from the Japanese businesses, that if Japan is exempted in a way, like the Five Eyes countries, would be a great progress. There’s already an evidence that there’s a strong confidence built within the CFIUS framework. I just got the data from the CFIUS filing from the last year that Japan has been the number one investor in the critical technology businesses, in the in the critical technology businesses in the United States. So, that already shows how much confidence the US government has found in Japanese businesses. And even though Nippon Steel case was a unfortunate precedent, but it was overturned, and very fortunately and we are very grateful for that. So, we hope this kind of confidence will be built into a better situation whether Japan will be given a special condition in a way.

Ken Weinstein:

Sure.

William Chou:

If I may jump in, I think in terms of the question of CFIUS and this $550 billion investment fund, so I’m sorry, my understanding is that there’s no explicit connection between the two, but I think there’s a lot of implicit connection between the two. Certainly, I think in the, what is it, December 2023 report that the Select Committee on the Chinese Communist Party produced in terms of competing against the PRC written by—

Ken Weinstein:

And chaired by our Hudson’s new colleague, Mike Gallagher. Sorry to—

William Chou:

Hey Ken, I wanted to give Mike credit—

Ken Weinstein:

Little infomercial here.

William Chou:

I wanted to give Mike credit.

Ken Weinstein:

Got to pay the bills.

William Chou:

But yes, authored or led by our colleague Mike Gallagher, they talked about adding Japan to the CFIUS whitelist. That was where the idea first came out. And so, what we see here is that there’s still no discussion about Japan being on the CFIUS whitelist. There’s been nothing about that so far. That said, the March 2025 executive order on the investment accelerator, or maybe it was the February one, essentially said that any country that invests over a billion dollars in the United States will get fast-tracking through the regulatory and financial review. And so, that is pretty close to essentially what the . . . It certainly would place Japan well in a good position, especially if you consider the fact that a lot of these $550 billion investments are all a billion dollars or more. Some of them, according to the list that we saw come out of the Takaichi and Trump meeting, they’re totaling, some of them are $20, $25 billion.

And so, I think the framework is there for there to be fast-tracking on CFIUS to grant Japan favorable terms. I think ultimately that will be an administration decision, but I will say that both the executive order on the investment accelerator is also the Office of the Investment Accelerator, which is also the same office that will be overseeing these $550 billion investments on the American side. And so, I think there’s a natural opportunity there for them to provide CFIUS review to Japan, or to start the process of fast-tracking. I think the opportunity is there, but ultimately that is still an administration decision.

Ken Weinstein:

Of course, a number of us would like to see Japan exceed to the Five Eyes and the move of Prime Minister Takaichi to talk about creating a new intelligence agency, the deepening of the information security, cybersecurity, the industrial security all bodes well for moving that direction. Let me ask one more question before opening it to the audience. There’s this other paradox which I hear from our friends in both South Korea, Taiwan, European friends as well, Japan invests in the United States. It then has to bring over some Japanese equipment in order to build some of these factories, and all of a sudden the Japanese trade deficit with the United States grows because of these investments, and there’s no waiver. And I don’t believe there’s a waiver in this debt obligation vehicle for that, which is really, I think necessary. And the Taiwanese in particular have been hit badly by the TSMC investments, so much so that I’ve heard Taiwanese companies talking about potentially moving some investments to Canada, because at least right now under USMCA, information can flow freely between the countries and it’s not going to increase their trade deficit with the United States.

I’m just wondering if thoughts on what might be done to address that concern.

William Chou:

Sure. I mean, look, I think this is a case where . . . I’m sorry. I think if you look at the recent history in terms of what the administration has done on tariffs, and also how it’s reacted to our friends or our ally partners bringing up concerns. So I think this administration, yes, it is very active with tariffs. Yes, it’s very proactive on trade policy, economic policy. Frankly, it’s been pretty challenging to try to keep up with all the things that the admin has done this year. I think everyone in this audience certainly has felt that. But at the same time, I think the administration has demonstrated a willingness to listen and to adapt just according to the certain circumstances. So, one example is the export credit for automobiles. Essentially, automakers that import into the United States but also produce in the United States can essentially earn an export credit when they export the cars made in the United States overseas.

I believe this is something that Japanese automakers, especially the Japanese Automobile Manufacturers Association really pushed hard for. Back in April, they received essentially a waiver until 2027. And then, more recently in the past few weeks it was extended to 2030. And that along with, I think the recent changes to the tariff schedule for countries that have made trade deals with the United States on certain items, say coffee that we simply cannot make in the United States, and reducing those tariffs down to most favored nation levels, demonstrates that there is room for adjustment, and accommodation, and discussion with this administration. It’s certainly very time energy consuming, it certainly involves a lot of engagement, but one, I think there is room to engage. Two, through this consultation committee Japan will have the opportunity to directly engage with decision makers within the administration. And yeah, I think certainly these are issues that should be brought up during these discussions.

Teruko Wada:

Yeah. And thank you very much for raising that topic actually. I appreciate that you suggested the possibility of the waiver on tariffs, because according to the fact sheet between the Japan on the Japanese investment, there are many projects that shows that there’s possibility for procuring from Japanese companies, like supplying from Japanese companies, even the project owner is American companies. So, that should allow the possibility of having Japanese supplier involve this kind of positive project, even though ideally for maybe US government, if you can procure 100 percent materials and supplies, everything domestically, it would be ideal for US government, but I think it’s unpractical to think at this point.

And also it takes time for even any manufacturers to build up factories here in the States and start operating. So, at least I think there should be an effort to give some waiver to those imports from Japan relating to this kind of positive investment project so that they will encourage further investment in the United States. And that kind of waiver also applies to possibly like a visa issue as well. Even though the workforce development discussion we just did, Japanese companies are trying very hard to nurture the workforce here in the States, trying to hire as many local American people as possible, but it takes time to raise the skills of the workforce there. So, maybe at the initial phase we may need some extra people coming from Japan so that that will expedite the investment process too.

Ken Weinstein:

And one of the striking things from the president on the recent Asia trip was the apology for the raid on the, I guess it was an LG factory. It wasn’t actually a—

William Chou:

Hyundai plant.

Ken Weinstein:

It wasn’t a Hyundai plant, it was a plant of subcontractors to Hyundai, and the president actually apologized for it, which was striking sign that he understands the workforce challenges that we’re facing. Let me open it now to the audience for questions. Please ask a question, keep it brief, and first identify yourself. I know there are a number of journalists in the audience as well, so if you have a question, please raise your hand and we’ll get you a microphone. Yeah, we’ll get you a microphone. Hey Will, we’re done at 3:00, right? We’re done at 3:00, right? The panel ends at 3:00? Yeah.

David Gossick:

Yes. My name’s David Gossick, independent consultant, formerly president of the US-Japan Business Council. My question is, is there an inherent tension between investments that are going to be developed under the investment fund versus just a normal Japanese company that says, hey, I want to build a $50 million plant in the US? Are they going to face some sorts of pressure or incentives to somehow get incorporated into this fund to make the investment, which could in fact slow down investment rather than encourage it?

Ken Weinstein:

Excellent question. Who wants to answer it?

William Chou:

I’ll take the first stab at it. Yeah. I mean, I think you can look at it in two different ways. Certainly the expectations that we will use up the $550 billion in three years. And so, I think Teruko mentioned this earlier, say an existing company wants to make a $20 billion investment. I mean, in a way, if the company decides to make that investment, should it . . . I’m sorry, let me start again. I think the administration has been very clear that they want more foreign direct investment in the United States, one way or another. So the question then becomes, say a Japanese company wants to make an investment in the United States, that’s $20 billion. Do they want to use their own private efforts, their own relationship with banks, or do they want to rely part of it on the $550 billion fund?

Should they choose to use their own efforts, because of whatever reasons, because they want all the profits? Then that doesn’t actually count towards the 550, even though it achieves what the administration wants, which is to encourage more foreign direct investment, more investment in American jobs, so on and so forth. And so, I think there is an inherent tension there. But on the flip side you could see in terms of like, say in the strategically important sector, where a project would not take off without the $550 billion investment, that does actually facilitate actual investment that otherwise would not have occurred because it just doesn’t meet the threshold otherwise without the $550 billion fund. On top of that, and this is based on my own conversations with finance firms that are looking into this issue, the fact that the federal government is willing to provide favorable leases on land, energy, water, so on and so forth, essentially provides further incentive, essentially higher assurances that this will be a profitable venture.

And so, that may actually create a double effect of, one, encouraging loan guarantee business on the $550 billion fund section portion of the investment, this is where I really wish I had a whiteboard, but also on the private side where the private company is still probably going to be funded by a Japanese or American private financial institution. And so, essentially the financial institution can double dip and benefit from the larger project all being supported by the federal government. So, there are two different ways of looking at it. It’s a little complicated, as you can obviously tell from my expression and my desire for a whiteboard, but I think there are two different ways of looking at it.

Ken Weinstein:

And you don’t see it crowding out some private investment at all? One sense . . .

Teruko Wada:

It’s up to the project owners to decide where to source their fund, and it’s not like attention, rather I would see it as having alternatives or options. They could continue to stick to the original finance that they were planned to use. When they see commercially viable, they will continue to use the original existing financial options. And if they see this new framework presents a better way to finance this project, then they would choose to take that option. I would not phrase this as a tension, but rather I hope to see as a positive options that businesses can choose.

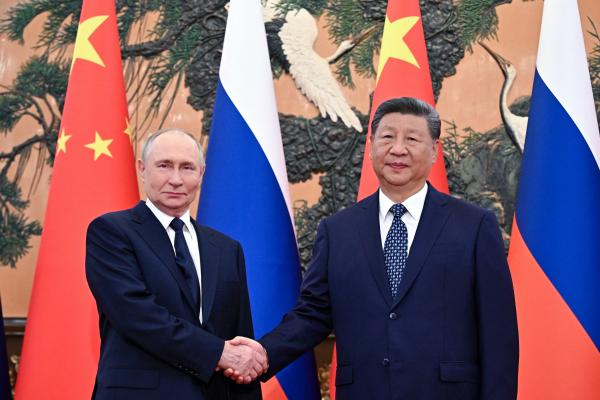

William Chou:

Yeah, yeah. I totally agree with Teruko there. I mean, I think if you look at all the different economic security challenges that we face, we just went through essentially six weeks of economic coercion, blackmail, whatever you want to call it, by the PRC over rare earth minerals as well as legacy semiconductors for automobiles. We just experienced that. The number of projects that we need to do to ensure that . . . I believe the playbook on that side is that they will continue to use these coercion weapons until they are no longer effective. And so, if you assume that that is the case, then we have a lot of things that we have to work on to ensure that we are no longer coerced, both ourselves as well as our closest allies. And so, if you look at it that way, the number of projects that we need to invest in, there’s no shortage of them.

And so it becomes a question of, in terms of the projects, what is the most efficient allocation of capital? Is it through your own private means, or is it through partial support from the $550 billion fund? That’s the real issue. When should you use your own private means and when are the projects a little more commercially challenging that where the 550 would be more beneficial?

Ken Weinstein:

Great. And other questions? Great. Let’s start back here. Yeah. Let’s keep the answers a little shorter since . . . Great, thank you. And let’s keep the questions shorter, and identify yourself please.

Ron Uba:

Thank you. My name is Ron Uba, I was right across the street at Department of Commerce Procurement Acquisitions. My question to you is with the multiple streams of revenue and income that you could generate, are you also looking at the possibility of doing what’s called matching funds that would go to joint ventures first, or would they have a order in terms of multiplicity of deals? What would be most lucrative as far as products, services, and goods? Thank you.

Ken Weinstein:

Let’s hold the mic over there. That’ll be the next question, yeah.

Charles Sills:

Thank you. Charles Sills, American Defense Alliance. Following up on incentives under this loan program, let’s look at a particular sector, shipbuilding. From the conversations in Tokyo, et cetera, et cetera, does it look like there’ll be a more attractive or a different set of incentives for Japanese shipbuilding companies to come over here as opposed to the recent experience with Korean shipbuilding companies, for example, Hanoi purchasing Philly, Philadelphia Shipyard? Do you see any differences or new factors?

Ken Weinstein:

Great, okay. Let’s take both those questions and then we’ll go over there next. Great. Yeah.

William Chou:

I can go first if you prefer. In terms of matching funds, I got to be honest with you, that’s something that I think is ultimately a government to government decision. We are unfortunately not privy to that. I will say that I did work very, very hard to try to get Japanese government and American government to get on stage. In my place today, I came this close with one side. I will not say which side, but I came this close.

Ken Weinstein:

Ours is shut down.

William Chou:

I’m not giving away any answers, Ken. But regardless, I mean, I think that’s a government to government issue. And so, the purpose of today’s conference is to explain what we can, what we do know. And then obviously with panel two, to address these are areas of industrial choke points, bottlenecks that perhaps maybe the 550 can help solve. We are trying to essentially work in parallel with the government to government negotiations right now, we are trying to be proactive in trying to address the ways in which we can look at ways to improve our industrial framework. So I apologize, I don’t think there’s an answer to that.

Ron Uba:

But basically you’re trying to cultivate relationship between—

Ken Weinstein:

Absolutely.

William Chou:

Yes. Yeah. And then in terms of shipbuilding, I think that’s something that is still being worked out. I know that the US, Japan signed a working group agreement to address ship building issues going forward. My understanding from my own conversations around town is that I don’t think that there’s necessarily a desire to replicate exactly what the US and South Korea have agreed to. And also on the Japanese side, there’s also recognition that if we do exactly what the South Koreans do, we can’t compete. Japanese facilities are too small, they’re out of date, they have a lot of their own work to do in terms of bringing them up to date. Their best pathway towards competitiveness long term in the next 10, 20, 30 years is to actually invest in cutting edge ship styles. So, they are not going to necessarily compete on LNG carriers.

That is something that the Koreans have done extremely well at, let them have it. We will focus on maybe other designs that might be more viable in the future. I think that is their approach. On the US side, my understanding is that there is an expectation that perhaps . . . I think there’s a similar expectation. There’s no expectations that the Japanese are necessarily going to do the same thing that the Koreans are doing. Instead, they’re looking at other ship designs are maybe more for the US market that would be more beneficial in other ways. So, I think there is some sense of like maybe one country should be focused on one sector of the the shipbuilding sector industry, and the Japanese can focus on the other sector. And the whole purpose of this working group is to try to work out these differences and better allocate limited resources, because frankly, resources are pretty limited in both Japan and the United States on this issue.

So yeah. Teruko, anything to add?

Teruko Wada:

Oh, I have nothing to add actually. Will explained everything for me.

Ken Weinstein:

Wow. Okay, wow.

Teruko Wada:

Yes, thank you.

William Chou:

Wow, geez.

Ken Weinstein:

We’re making progress here. Okay, great. Over here then, to the fellow . . . Yeah. And then the woman in front of you. And then, let’s take both questions and we’ll wrap up. Okay? And please identify yourself, thank you.

Shelton Metcalf:

Thank you. Shelton Metcalf, US Ocean, a US-based maritime company. My question was partially answered already by the shipbuilding question, but just to build off of that, I think you mentioned that there were talks already on shipbuilding is probably related to this working group. Are any of the 20 projects related to shipbuilding? Because I looked at the list but didn’t see any. And then more broadly, the focus given these restraints really become more broad than just shipbuilding, but more maritime sector related.

Ken Weinstein:

And then, take the other question right in front of you there, and please identify yourself.

Erin Gallagher:

Thank you guys so much, I’m Erin Gallagher with the Asia Group. So, speaking of those 20 projects, and I know at the beginning you mentioned some lingering ambiguity. I think the interpretations, the fact sheets that came about on either side on those projects, we have the US side calling them commitments while the Japanese side called them interest. I know you don’t have a crystal ball, but I am curious if you have any insight on how you think that might shake out in terms of which interpretation we might actually be closer to what we get.

Ken Weinstein:

Great. Those two great questions. Who wants to take a crack at it? Either way.

Teruko Wada:

I cannot foresee what’s going to happen, first with the second question. I don’t know what’s going to happen with the 20 project. They’re like a presentation of the expectation they’re going to invest, they’re willing to invest, but we don’t know the majority of the planning process at this point. And of course, they have to look into the details about the conditions of this investments framework. So, it’s up to more closer scrutiny, so to speak. But I’m very hopeful that both governments, especially I’ve been speaking with Japanese government people, but they’re eager to work with individual projects and they try to come up with individual solutions to help facilitate the investment decision process. So, I hope there’s some positive turnout would show eventually. And about the shipbuilding issues, the first question, my understanding is that currently Japanese government and the Japanese shipbuilding industry, they’re focusing more on the domestic capacity building actually.

I know there’s a strong expectation from the United States to have robust shipbuilding industry here in the States, but we don’t have, for example, we don’t have a up-to-date dockyard to build the ship, we don’t have the supply chain to sustain the shipbuilding industries here. We have to build them from like not scratch, but from like one or two out of 10. So, that requires a lot of investment and longer term commitment. So, I don’t think there’s a quick answer to that question, but still I have to admit that currently Japanese governments and businesses are focusing more on domestic capacity building, but that should help expedite the way to the investment in the United States too. There should be a link to it.

Ken Weinstein:

Great. Will, anything to add before—

William Chou:

Yeah, yeah. I would just say, Sheldon, thank you for that question. I know we’re talking a lot about shipbuilding. I would just point out that in, I think sometime in January, Hudson will be hosting a conference on US-Japan shipbuilding cooperation, so please come again in a few months. But to answer your question, I think on the broader issue of shipbuilding, I think actually looking at the administration’s focus on AI is actually a very good example. The administration clearly wants to be technological leaders in AI and demonstrate technological leadership there. If you look at what they’ve done is that they’ve actually broadened out the definition of AI to AI infrastructure. And so, you’re seeing a lot of the projects in the 20 something projects to include things like data centers, to include cooling systems that you would need for AI infrastructure.

And so, I think it’s very natural that if we do go down the shipbuilding route for this $550 billion investment fund, that you will see similar expansion into these related sectors. So, say things like say cranes for shipyards, or building up the supply chain network for American shipbuilding. So, I think that’s very reasonable. To address Erin’s question, I think I touched it already. I think in terms of the projects that they listed from both the METI site and also the US side, I believe my guess is that there are probably initial conversations, sort of like, “Hey, these are some viable projects. We’re having some conversations about them, let’s continue on. But in the meantime, let’s just put them down as just some projects that we should consider that we think are very viable on both sides.” I don’t know how close they are to actual becoming real projects.

My guess is that we probably won’t get the first projects until probably Q1, late Q1, if not later. But in any case, I will say that the projects that you’re seeing are very much in line with the areas that are of interest to the administration. So things like critical minerals, things like AI data centers and it’s surrounding infrastructure. And so, I think the document provides a guideline to the areas in which they’re interested in, not necessarily the actual final projects. And I think I’ve heard that from more than a few people when I was in Tokyo.

Ken Weinstein:

Great, perfect. Thank you very much, I think it’s been a remarkable panel. I know I learned a great deal. Despite the government shutdown we’ve landed on time, 3:00 p.m., in time for the next panel. I want to give Will and myself extra credit. Neither of us mentioned the Alaska LNG pipeline.

William Chou:

That’s amazing, that’s amazing.

Ken Weinstein:

Good to see an event on Japan for the first time—

William Chou:

That’s amazing.

Ken Weinstein:

. . . in probably six months, but I really want to thank both Will, Teruko. It’s been a fascinating conversation. Looking forward to the next panel, thank you very much.

Teruko Wada:

Thank you very much.

William Chou:

Well, thanks to Ken and also Teruko for the wonderful discussion that we just had in the last panel on the background, the parameters and some of the challenges of the $550 billion loan fund, investment fund. I have to work that out myself. Now I want to turn to understanding some of the challenges and potential solutions in the various priority strategic sectors. And so for that, I want to turn to this wonderful group of industry experts that we’ve assembled here today, who can best expound upon these issues. And to make it very clear for everybody, these industry representatives are not on stage to commit to any investments. That is a purely headquarters, corporate planning, corporate strategy issue. I cannot tell you how much I have to explain this, especially to the Japanese side, and some of you have heard it from me too.

Rather, they are on stage to lend their expertise of the industries and related sectors, and to identify bottlenecks and constraints that we should find solutions for. Solutions that perhaps could be dependent on the $550 billion investment fund in order to ensure that we can best ensure US and Japanese industrial, and technological leadership.

And so, just as a quick introduction, we have Jennifer Thomas to my left. Jennifer Thomas, senior vice president of corporate affairs at America Honda Motor Company, where she oversees government industrial relations, communications, and regional corporate affairs. She is also the company’s top liaison to the White House and major industry trade associations, like the Alliance for Automotive Innovation and Autos Drive America.

She joined Honda in 2019 and previously served as a VP of government affairs at AAI, then known as AAM, playing a role in the implementation of various auto industry policies in the area of environment, safety, logistics, and trade. Originally from Kentucky, Jennifer graduated with a BA in psychology from GW University, George Washington University.

To her left is Reese Goldsmith, the head of government affairs at Ara Partners, overseeing the firm’s government affairs practice, and also policy monitoring, and outreach to officials. Our partners is the owner of VAC, which is a German rare earths firm that has started production in South Carolina in Sumter through its subsidiary, EVAC, I believe.

Prior to coming to Ara, Reese was senior policy advisor at Holland and Knight, and then also at Brownstein, Hyatt, Farber, and Schreck. In both firms, she worked on federal grant and infrastructure projects, energy and environmental policy. She has a BA from Virginia Tech, a JD from Catholic University, after which she did clerkships at the DOJ.

To her left is Quynh Tran, who is deputy head of structural finance Americas at SMBC. She has over 20 years of experience in the infrastructure sector covering digital transportation, airport, power, water, social infrastructure. She led the build-out of SMBC’s coverage of digital infrastructure sector, helping SMBC become a leading bank in this area. She’s a double Columbia grad with a BA and MBA from the school up in Morningside Heights.

Finally, at the very end, we have Eric Wilkinson coming down from Boston, even though his organization is based in Pittsburgh, director of energy and regulatory policy at Mitsubishi Electric Power Products, or MEPI. He has a great deal of experience working in energy and regulatory affairs, having worked at Orsted North America, ISO New England, the New Jersey Board of Utilities, and the EPA.

Unfortunately, he’s a graduate of University of Michigan. I went to Ohio State—

Eric Wilkinson:

Four times in a row.

William Chou:

. . . and Vermont Law. We’re pretty thrilled to have him here today, and the rest of the panel here today.

I guess we talked about some of the broader structure of the $550 billion fund earlier. I guess what I really want to do is get your take on the policy side, on the industrial side, especially with an eye towards recent events.

The first question, I really want to target towards Jennifer, and also Reese. Rare earths and supply chains are now hot topics for all the wrong reasons due to China’s use of its dominance in rare earths, and like say semiconductors for us back in May and now again in September and October where they’ve used them as essentially forms of economic coercion or certainly impacting manufacturers and OEMs.

So I guess for Jennifer, I guess my question is, what was your reaction and why do these supply chain disruptions pose such a large impact on automakers like Honda?

Jennifer Thomas:

Well, thank you, Will, and thank you for having me as part of this discussion. I really appreciate the disclaimer upfront about no commitments. I have no investment commitments to make today, but I will say that Honda has invested heavily in the US and really embodies the importance of the US-Japan alliance.

We’ve been building our products here in the US for more than 40 years and have 12 manufacturing plants, invested more than $25 billion, and have 30,000 associates, but there’s always room for more. To your question, my reaction was obviously deep concern and alarm. I didn’t think that I would be talking about neodymium magnets for, like, every day for a month or more.

When it happened in April, it was shocking and . . . at just the speed of the impact. Auto-making in North America nearly grounded to a halt. Thanks to the intervention by the Trump administration, things have improved, but it really demonstrated how strategic materials can be used now as geopolitical tools. And so, that vulnerability, that reality should be a wake-up call for US, Japan, and other allies.

And so, it’s going to take all of us working together to kind of take back that leadership. China has obviously dominated this area, and we’re behind, but I’m hopeful that this investment fund or whatever you want to call it, provides an opportunity for the US and Japan to really work together and tackle this issue so that we are no longer reliant or vulnerable to these sorts of geopolitical tensions.

William Chou:

Great. Well, I mean, Reese, I’d like to turn this experience that we all had to you from our partners’ perspective.

Why does China have such a stranglehold on the rare earth sector? What was our partner’s response to its use of economic coercion back in April, May, and then again in September to October?

Reese Goldsmith:

Yeah. It’s quite a long story, so I don’t know how long people have. No, but I actually started with Ara about two years ago, right near the finalization of the acquisition of VAC. Ara is a Houston, Texas-based firm that provides growth stage equity for building out assets. We also are supported by a significant engineering team, our apex engineering team that ensures we can deliver projects at cost and on time.

To give a little bit of a history of how I’ve been tracking this issue throughout my career in 2017, during the first Trump administration, the president signed a presidential determination that rare earths and rare earth permanent magnets were essential to national security. VOC and a number of players in the space had been talking to the Department of Defense and the US government, how do we reestablish this supply chain?

It was largely a slow march, until all of a sudden with our acquisition of VOC, we started building. The actions in April and then the escalation in September on the rarest piece has certainly made it a busy year for us. How we got here was sometimes democracies don’t get to centrally plan in the same way that other governments can. And so, this has been a long targeted strategy by the Chinese government to have this leverage over the United States and other economies.

The way we think about it is partnering with the US government. We received a $100 million DPA Title III grant from the Department of Defense. In addition to that, we’ve received $111 million in 48C tax credits. And that, along with certain trade actions, have made the project financeable by the private sector so we received a large private financing to move the facility over the needle and essentially get it built.

We’ve built a 2,000 metric ton facility in Sumter, South Carolina. This morning, because actually my colleague was supposed to be here and I’m filling in for him, but that’s because Treasury Secretary Bessent was down this morning at our facility to essentially be there to celebrate the first magnet coming off the production line, re-shoring an industry that hasn’t been in the US for the last 25 years.

We’re very excited about that, but it takes a lot of patience, a lot of perseverance, and an 18-month construction of a facility that is 18 football fields large is quite an undertaking, but we’re very proud of what we’ve achieved.

William Chou:

Yeah. Well, first of all, obviously congratulations to Avaka and our partners for producing that first magnet, and hopefully there’ll be many more coming down the line. I think the things that you’re talking about here in terms of 18 months to actually produce that first magnet, the amount of money that you’ve received through DPA grants as well as tax credits, all the support.

I mean, I guess ultimately, this is a question for both Reese and Jennifer. I mean, what are the challenges and bottlenecks that complicate our ability to solve these issues? I think 18 months, I think most people would be very impressed, but what could we do better? And so, what are the challenges that we should look to address? Can you give us some kind of scale of the constraints that we’re dealing with here?

Jennifer Thomas:

Yeah. Well, I think off-take is a big one. Having partners commit to on-shoring strategies is essential. Our facility is underwritten by long-term off-take agreements, and Ara would not have felt comfortable building out this facility without an off-take agreement to underpin it. So making those commitments is very helpful.

Then financing is challenging. We’re the equity going in, and that’s some of the hardest capital to find. So figuring out equity-like arrangements, as well as other types of non-recourse project finance type structures that can be deployed quickly, understanding that there’s always risk when you’re building out new facilities or trying to do new markets, but we’ve found ways to de-risk that by creating good partnerships across industry, across government, as well as technology partners.

Reese Goldsmith:

Yeah. Just to add on that, I mean, I’m impressed that it only took 18 months, and I think that was probably made possible because of the use of BPA. And so, eliminating those regulatory hurdles to get these facilities up and online is key. Permitting reform is certainly a key aspect of that in financing, but just other red tape hurdles that are just known to exist within this country and around mining, I think just trying to eliminate those as much as possible so that . . . Because ultimately, speed is of the utmost importance here.

William Chou:

Terrific. Well, I really do want to get back to you guys about some of the things that you talked about, but let me just quickly shift attention over to Quynh and Eric just to talk about . . . We talked about supply chain’s critical minerals here with Jennifer and Reese. I’d like to shift a little bit to the administration’s other priority, which is data centers, and AI, and data center infrastructure.

So for Quynh, I think how has the data center industry developed in the last few years and what are some of the key drivers for that? Can you just give us a bit of a background on that issue?

Quynh Tran:

Sure. I’ll try to keep it relatively short, but I know myself and all of us can’t stop by a TV screen or open a paper and not see a headline on AI, and what all the companies are doing to win this race to be the dominant player in AI. I would say that this industry, the data center industry, which essentially supports all the AI growth, has been around for a very long time.

At SMBC, we touched on our first data center construction, Greenfield Project, in 2017, so almost 10 years ago. At the time, the financing source was not typically project financing, but I sit in the infrastructure team. We saw this lease that essentially was a 15-year contract with a very strong tech company and we said this is actually essential infrastructure, and it’s been proven more and more now through COVID and everything that we’re seeing today.

And so, we provided the first financing of a data center in the Americas using the project finance model. That transaction at the time, I remember the developer was extremely happy because they had signed a 20 megawatt lease. At the time, that lease was considered humongous in the industry. It was definitely something to be proud of.

The financing related to that was about 220 million. For the next five or so years, we continued to finance many of these data centers being driven by the growth that the likes of Amazon, Microsoft, Google were seeing in their cloud business. Then 2022 hit when post COVID, everyone began realizing how truly essential this asset class was to everything that we do, so we began seeing projects going from 20 megawatts to 80 megawatts to 100 megawatts, to today, where we’re seeing one gigawatt projects.

In terms of the dollar sizes, I mentioned that first project was $220 million. The next mega project was in 2022, was really when all this took off from the cloud side of things, was about 110 megawatts. The financing related to that was $850 million. I can tell you from 2024 until today, almost every project that we touch is bigger than the last one, and they are jumping in multiples. There’s a $2 billion project going on, to a $3 billion project going, to a $5 billion project. And now, the numbers for a single project could be double-digit, multi-billion. We’re talking $10 billion, $15, $20 billion projects.

Reese mentioned her asset being 18 football fields. I’m not a sports person, so I can’t really say how many football fields, but I am a New Yorker. One of the projects that we’re working on is the size of Central Park in New York City, just to give you a sense. On that site, there are over 1,000 workers putting together this very large data center. The numbers that I’ve also just mentioned to you all, that is just for the skeleton of the data center, so what we consider the infrastructure.

Data centers are essentially houses for power and they will house servers. The servers need the power, they need the fiber. The numbers that I mentioned are just for that structure, that physical structure. What goes inside the data center is actually way more expensive. If you’re talking about a cloud data center, what goes inside that cloud data center is generally about two times what it costs to build that data center. And that, those servers and equipment are generally recycled every five to seven years.

This is the continuous investment that these hyperscalers have made. If we’re talking AI, which is the topic today, going from cloud to AI, the investment is between seven to 10 times what the cost of that data center is.

William Chou:

Wow. Those are some huge numbers there. Again, I wish I had a whiteboard. I will say, so Eric, you’ve been very patient, but Mitsubishi Electric Power—

Eric Wilkinson:

Power Products.

William Chou:

Oh, Products. I’m sorry, MEPI. I’m just going to stick with MEPI. I mean, MEPI is a key player in all of this. You guys are also building some of your own data centers.

Can you talk about some of the ways in which MEPI contributes to these efforts? Because I think certainly some of us are not as familiar with MEPI’s work, but from my own conversations in Tokyo, you guys are really involved in a lot of different aspects of it.

Eric Wilkinson:

Yeah, thanks. And thanks to the Hudson Institute for hosting us today. I really appreciate it. Appreciate the opportunity.

Yeah. So Mitsubishi is a big company that most people have heard that name before. MEPI, our little part of that universe, is much smaller. I’m here today only speaking for the MEPI side of the business. We have . . . All the Mitsubishi companies in the United States have common ownership in Tokyo, and it’s that entity who has been identified in this MOU as potentially receiving up to $30 billion for investment here in the US.

What that means, I still really don’t know even after that informative conversation we just had. MEPI, one of the things we do in addition to building giant video display screens and the HVAC system for the New York City subway rail car systems, we also design and build data centers, especially the cooling aspects of those. We have also a business that does the engineering studies for either large loads like data centers, or generators, or transmission owners when they want to connect to the grid.

We see it from many different angles. As we just discussed, the power is the biggest bottleneck for sure for data centers because of the size and the scale that we’re seeing the developers go with now. We also manufacture things like circuit breakers, grid size circuit breakers, and we currently have a three or four year backlog on those. We’re building a brand new factory in Pittsburgh to reduce that backlog, and we were able to take advantage of some 48C grant tax credits for that as well.

Just as we have backlogs on the circuit breaker side, the gas turbine, people have backlogs on those so developers are facing backlogs every which way they look. Those are some of the bigger challenges that we’re seeing right now.

William Chou:

Fair enough. Well, so I mean, I certainly have heard some similar concerns from other places as well. I think in terms of the tremendous growth of AI-related investments, which Quynh just laid out in terms of growing from, what is it, 20 megawatts in 2017 to one gigawatt today, the scale of growth in just eight years.

With this growth in AI and related investments, which dominate the new cycle, how does this create pressure for each of your industries or for each of your sectors? So for Eric, for engineering solutions like MEPI, how have you kept up with these project demands? Or have you not been able to? For Quynh, financial firms like SMBC, how have financial markets kept up with these investments as they’re just massively growing in size and risk?

Either one can go first.

Eric Wilkinson:

Just very quickly, we are . . . As you guys talked about earlier, there certainly is a challenge in finding labor right now, especially for electrical engineers. Back from my days at ISO New England, that was a problem 10 or 15 years ago. It still remains a problem. We don’t produce many of those in the United States anymore.

We are starting to use AI to help those engineering studies, to help design for the data centers. We are kind of using AI for AI, which I hope doesn’t start some vicious cycle that we never can get out of. Anyway, I won’t go there existentially, but yeah, those are some of the things we’re doing.

William Chou:

Sure.

Quynh Tran:

From a financing perspective, I have been at SMBC . . . Just to take a step back, for those who don’t know, SMBC is one of the three mega banks in Japan. We have been extremely thrilled to see the level of support that the financing community has given the data center and now the AI sector. A lot of it goes back to what I said about this being truly essential.

If you view cloud and all the data that we’re generating, I don’t think any of us can imagine a world where the data that we all produce today is going to be more than the data that will be produced even like 10 days from today. The industry tailwinds and kind of the story behind all of this is extremely strong, which has really driven a lot of the support that the financing community has given the sector.

What was new when we did the transaction back in 2017 was, we had no idea back then what a data center was. I don’t know if many of you can imagine what a data center looks like. Perhaps you can, just given the news cycle today. Going back to 2017, if you were to come to me and say, “I need an airport financed or I need a bridge financed,” the analysts and even the associates, or really anyone on the desk, can at least think about like, how do I analyze the risk profile of an airport?

If you throw a data center at someone and they’ve never even thought about cloud and how these revenues are generated, it’s a very hard analysis to make. We spent, and the financing community, spent a lot of time over the last eight or so years getting to understand the sector. Once you understand it, it’s a very, very strong story. The difficulty was going from a $200 million financing to $1 billion financing, and then three months later, realizing you have to raise two billion, and then three months later it’s five billion.

This is just single project, but at any one time at SMBC, we are working on multiple billion dollar project financings. The work is in educating more and more banks. It may surprise some of you that the Asian banks, and including the Japanese banks, have been a very big component of many of the bank group compositions for these large projects in the US. So growing the bank group, but also growing the investor base.

We’ve been really pleasantly surprised at the growth of the bank group as well as being able to develop new product classes, new product areas. Outside of project finance, the US private placement market, the ABS markets, growing those markets, doing the first of their kind in those markets for the data center asset.

And so, it’s been really nice, Will, but we are talking now $15 billion, $20 billion, multiple $15 billion projects at a time. That’s something that we all collectively need to work on.

William Chou:

Yeah. Well, I mean, with those massive numbers, I mean, if there were only some kind of a fund out there that could easily accommodate $15, $20 billion at once. That would be—

Quynh Tran:

I would say though, part of the reason why it’s worked is everyone’s contributing to helping make it work. The hyperscalers are adjusting their leases to make it more comfortable for a bank. And so, if there are things such as making the permitting process easier where you de-risk the project itself, that is also something that would help on the financing side of things.

William Chou:

I’m glad that you brought up regulatory and de-risking. Obviously, very, very excited to hear that the finance side is rising to meet the challenge. There are new ways of raising the money with these massively increased scale of costs.

I guess in terms of . . . This is for Quynh and for Eric, what are some of the industry dynamics that are driving growth? At the same time, so financing is . . . There’s been a lot of hard work being done there, but what are some of the bottlenecks and what are some of the constraints that are hindering continuing development or effective development?

Can you pinpoint either in your sector or in related sectors, maybe it’s a lack of power, maybe it’s the . . . I lived in Texas during one of those winters. I can tell you that power grids are a major concern. What are some of the choke points that we should be looking at in terms of this issue as we’re massively growing the size of the AI and also data center infrastructure?

Eric Wilkinson:

I’ll throw one more out there that we haven’t talked about yet, is the interconnection issues that are generally under FERC’s purview, the Federal Energy Regulatory Commission here in the US. They are beginning a rulemaking process to make more transparent and clear, and hopefully equitable, the cost distribution of grid enhancements associated with large loads and data centers. And so, hopefully that will help. Right now, it can be a bottleneck just across the river here with the largest data center conglomeration in the world happens to be, there is already backlash from ratepayers on the cost to the grid of these super large loads. So that’s one bottleneck that hopefully will be resolved fairly soon, but it remains a sticking point.

Quynh Tran:

Yeah. We’ve touched on a lot of the bottlenecks already. I would also add, like Eric mentioned, the power constraints. It’s taken a lot of hard work for all the growth thus far, and I don’t want to minimize it in any way, but a lot of what’s been done has been relatively low hanging fruit, at least from a power perspective.

So basically finding land, where that happens to be in a tier one data center market or tier two data center market, that has readily available power. So that’s generally what’s been done, maybe two or three years ago.

What’s getting more difficult now is we’re running out of power, and especially running out of power in those key markets. For AI development, it’s not as important really where your power source is. So that’s been kind of the second stage of all of this. The third stage right now, which is making things difficult is, now if the power grid will not be able to keep up, it’ll take three or four or five years to get the power there, but you need these data centers, AI data centers now. The thought now is to do behind-the-meter solutions. So that’s different types of structures that need to be thought through as well.

The other constraints are what we’ve discussed, supply chain. There’s certain equipment, many types of equipments that go into a data center. Some of them, just three years ago, the lead time was six months. Looking today, the lead time for that same piece of equipment is two to three years. So that’s a certain bottleneck as well.

William Chou:

Okay. Great. Thanks. If I can just follow up on that a little more. I’m sorry, Jennifer. I’m sorry, Reese. I will definitely get back to you guys really quickly. But what is causing, sort of delay in these bottlenecks? Is it something that could be solved? I mean, obviously a lot of you guys have sort of brought up the regulatory challenges, and I certainly accept that.

But are some of these bottlenecks, are they solvable with more investment or is it more of a better way of doing things? Is it a process or is it more of a resource issue?

Quynh Tran:

I think it’s more of a resource issue, because the growth has been so tremendous. So each developer, they’re developing their big projects, but they’re not the only project in town. So you’re all kind of fighting for, not fight, but you’re all competing for the same equipment.

So there are many developers today, if they have the financial wherewithal who are actually, I don’t want to say stockpiling, but they have this equipment sitting in a warehouse somewhere, knowing that they will eventually sign a lease for one of these projects.

And labor, you’re developing a $2 billion project, say somewhere in Georgia, right next door is another $2 billion project. It’s the same electricians and all that.

What I found really interesting was when we first started working in this sector, when we talked to these developers, they would definitely highlight, I have a really great, strong relationship with Hyperscaler one, two, three, and four, and I talk at the top of the house.

Today, when we talk to them, and if you also look at their LinkedIn posts, what they are highlighting is that we have a great relationship with this construction firm, or we have a great relationship with this equipment provider. They’re basically, kind of highlighting not just their relationships with the hyperscalers, because that’s almost a given today, but the relationship that they have with the labor community as well as with the supply chain community.

William Chou:

Okay, great. So I sort of want to ask all of you guys a question, because I think a lot of what we’ve talked about here so far is like the issue of essentially time, right? The fact that we don’t have slack, we don’t have . . . We’re hit with a sudden shock or a sudden demand, we don’t have the time or the resources to respond quickly, right? Things take time to build, things take time to mind or process.

I guess turning to Jennifer, first of all, I think some of the things that we’ve heard about Nexperia with the semiconductor limitations, how do companies, and this is really for everybody, but I certainly wanted to focus on Honda for this, but how do you guys deal with the challenge of slack, or sort of like basically having extra capacity or ability to deal with shocks to the supply? What are ways to sort of address this issue?

Jennifer Thomas:

So this is a difficult one. The Nexperia chip crisis has certainly resulted in us scaling back our operations throughout North America. And again, it’s another vulnerability that, who would have thought that a dispute between the Dutch government and China would have resulted in us cutting back our production significantly, because the inability to get access to these auto grade chips.

So I think we need to focus, and I think COVID should have taught us this and the first chip crisis should have taught us this, that we need to focus more on resilience versus efficiency. And I think that what this has exposed is that this, just-in-time, perhaps method, is no longer serving us in light of the current environment. And so that really emphasizes the need for a resilient supply chain. And so we’re hopeful that together the US and Japan can utilize this opportunity to really secure a robust, resilient supply chain.

And I know there’s a lot of focus right now on advanced semiconductor chips to power AI, but there also needs to be continued investment in these legacy chips, because there’s more than a thousand of them in the average automobile. And as vehicles become more sophisticated, electric vehicles, software-defined vehicles, those demand even more chips.

So we need to continue to invest in legacy semiconductor chips, even if it’s not sexy, and ensure that we have that supply here in the US to prevent these, sort of shocks to the system like we’re seeing now.

William Chou:

Anything else?

Reese Goldsmith: