Chinese Communist Party (CCP) General Secretary Xi Jinping’s May visit to France, Serbia and Hungary reveals much about how Beijing has modified its approach to Europe over the last five years. The selection of stops in his first trip to the region since 2019 focused on countries that consolidate strategic gains or offer special opportunities. Serbia and Hungary have been particularly receptive to China’s policy priorities in key strategic locations and France always seeks a greater international leadership role.

After years of setbacks in Central and Eastern Europe (CEE), Beijing has been focusing on cementing relations with its most promising partners in the region: European Union and NATO member Hungary, and unaffiliated but pro-Russian Serbia. In both countries, Beijing enjoys particularly favorable political and economic conditions. Past investments and diplomatic attention there are paying off nicely, offering China special opportunities to use these relationships as more robust bridgeheads and wedges into the continent.

Nevertheless, China’s presence – and influence – remains stronger in Western Europe, where its foreign direct investment and trade flows are much larger. Investment from Western Europe into China is also much larger and their economies are more dependent on the Chinese market, making them more vulnerable to coercion.

Less favorable political context

China’s brand in CEE is much diminished from 2019, not to mention the early 2010s, when countries across the region sought closer economic relations and were particularly open to more engagement through the then new Belt and Road Initiative (BRI). Most are now much less receptive to China’s messaging and engagement, even as the countries President Xi visited are keen to deepen ties across the board.

The former 17+1 format, a forum established in 2012 to expand investment, trade and infrastructure cooperation between China and countries in the region, has been moribund since Lithuania, Latvia and Estonia quit in 2021 and 2022. The last summit of the reduced 14+1 grouping in February 2021 was an embarrassing failure for China, after six countries declined to participate at the head of government level and to endorse a joint communique. The BRI, which once counted 11 EU member states as signatories, has also lost much support. Hungary and Serbia were the only European states to participate in the 2023 BRI Forum.

Most countries in Central Europe have de-emphasized their engagement with Beijing over the last five years, viewing China as having overpromised and underdelivered on trade and investment. Trade flows remain overwhelmingly in China’s benefit and leaders throughout the region consider Beijing to have badly mishandled the pandemic. They view the BRI and similar multilateral formats as photo ops devoid of substance, while considering bilateral engagements as necessary primarily to advance narrow economic goals, rather than to grow political or other ties.

Many Central European countries are also concerned about China’s growing exports of subsidized electric vehicles at the expense of the European automobile industry, a critical part of most regional economies given their integral connection to German and other manufacturers. Most regional leaders are turned off by Beijing’s aggressive “wolf warrior” diplomacy.

Perhaps most importantly, however, heads of governments and states in Central Europe are alarmed by Beijing’s “no-limits” friendship with Moscow and its large and growing support for Russia’s war against Ukraine. The joint communique Mr. Xi and Russian President Vladimir Putin signed just before the February 2022 full-scale invasion calling for NATO to roll back to its 1997 borders was a direct challenge to their membership in the alliance that guarantees their security in the post-1989 European order. Officials expressed these concerns to Chinese envoy Huo Yuzhen who in May 2022 visited eight countries in the region, while the Polish government refused a meeting on the grounds that Warsaw views the bilateral relationship primarily through a national security prism, namely China enabling Russia’s war.

Economics at the core

Trade and investment data illustrate that Chinese economic relationships with Central Europe remain modest. From 2014 until 2021, its investment in the region was a fraction of that in Western Europe. Germany, France and the United Kingdom (“the big three”) dwarfed Central European countries as investment destinations; they alone accounted for more than half of all Chinese investment in Europe between 2000 and 2023. Only since 2022 has Chinese investment grown in the CEE region, and then only for Hungary, where Chinese companies are building factories to produce components of, and to assemble, electric vehicles. In 2022 and 2023, Hungary received 21 percent and 44 percent, respectively, of total Chinese investment in Europe.

The low figures for investment elsewhere in Central Europe mask serious concerns about Beijing’s penetration in sensitive sectors such as telecommunications, as well as civil nuclear and security infrastructure, where Chinese companies Huawei and ZTE, CGN and Nuctech, respectively, are active. China has yet to achieve its objectives in all these sectors, but serious concerns over Huawei’s penetration of the telecoms sector, especially but not only in Hungary, remain. In aggregate terms, however, CEE countries were never structurally as important for China as Western Europe, nor are they nearly as dependent on China.

China’s image in CEE remains mixed. Roughly one-third of populations in the region view China as a direct security threat, according to the April GLOBSEC Trends 2024; only in the Czech Republic and Lithuania does a majority see China as a threat. Some 53 percent of Central Europeans, however, agree that China is trying to weaken both the EU and NATO. Views of China as a strategic partner have risen slightly but are still barely in the double digits (13 percent of regional respondents). This translates into less Chinese influence regionally than is often assumed, especially as compared with other European countries such as the “big three.”

“New Golden Age”

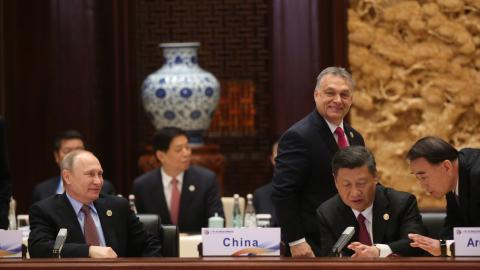

Prime Minister Viktor Orban’s recent engagements with Mr. Xi highlight the special relationship Hungary has developed with communist China. Mr. Orban’s July 7 trip to Beijing to discuss Russia’s war against Ukraine followed two months after Mr. Xi’s May visit to Hungary and reflects a mutual confirmation of their bilateral relationship. Both sides speak about it in glowing terms. In May, they upgraded their ties to an “All-Weather Comprehensive Strategic Partnership for the New Era,” a particular category of relationship coined by China that puts Hungary with the likes of Belarus, Ethiopia, Pakistan, Russia, Uzbekistan, Venezuela and Zambia. The two sides reiterated that the “new golden age” – underway since Prime Minister Orban announced his Eastern Opening in 2010 – continues, strengthening Hungary’s economy and protecting it against pressure from Brussels and elsewhere.

Perceptions of China as a strategic partner are particularly positive (34 percent) in Hungary, which appreciates that China is creating skilled jobs and contributing to economic growth. Budapest, in turn, remains neutral on CCP policies. At the July NATO Washington Summit, Hungarian Foreign Minister Peter Szijjarto reiterated his opposition to “NATO becoming an anti-Chinese alliance” even as he did not block the communique that contained language more critical of Beijing than in the past.

While most Central European countries have not been increasing Chinese involvement in their critical infrastructure, during Mr. Xi’s visit Hungary and China announced 18 agreements, including new deals in railway construction, oil pipelines, nuclear energy and media cooperation. There are plans for a high-speed rail connection between Budapest Airport and the city center, a pipeline and border facilities between Serbia and Hungary, a railway bypass around Budapest and a build-out of electric vehicle charging stations.

Cooperation in the Hungarian media sector amplifies Chinese narratives. Senior Hungarian officials routinely dismiss concerns about an agreement that enables Chinese police to patrol in Hungary, describing it simply as enabling interpreters for the large numbers of Chinese tourists and not dissimilar to agreements concluded with Germany and other countries. They also note that Chinese investment and trade in Hungary are still a small fraction of that in many Western European countries.

Hungary as China’s primary outpost in Central Europe

Hungary is embracing its role as China’s CEE gateway to the EU market and is eager to become an even more important link in China’s global value chains. Placing a major bet on the electric vehicle market, Hungary has welcomed major investments by the battery firm CATL in Debrecen, cathode material producer Huayou Cobalt near Gyor, electric vehicle manufacturer BYD in Szeged, and other firms. These further cement Hungary as the critical CEE partner even as China continues to invest major sums in other EU member states. This role fits neatly into Mr. Orban’s foreign policy concept – “connectivity” – which prioritizes cooperation and expansion of relationships in all directions and “avoiding the formation of blocs,” hence Hungary’s decision not to de-risk, let alone decouple from China.

With the EU continuing to block billions of euros in cohesion funds to Hungary because of an unresolved Article 7 case, government officials note the relationship with China offers important economic benefits while also signaling to the EU and others that Hungary has options.

For his part, General Secretary Xi has used these recent engagements to cement Hungary’s position as Beijing’s most important EU partner in Central Europe. During his latest visit to Budapest – celebrating 75years of bilateral relations, which he called “the best in history” – he stated that “China supports Hungary in playing a bigger role in the EU and promoting greater progress in China-EU relations.” Mr. Xi clearly sees Mr. Orban as an advocate for Chinese interests in the EU, for example, by vetoing or watering down measures harmful to China, including potential sanctions in the event of a crisis over Taiwan. China also seeks to locate factories in friendly EU member states to protect against tariffs or other restrictive trade measures that may arise in the future. Beijing also appreciates Hungary’s independent foreign policy.

Serbia as the central outpost in the Western Balkans

President Xi also visited Belgrade during his May trip, demonstrating the priority both sides place on upgrading their bilateral relationship, which some Serbians have called “steel-strong” since at least 2022. Making the most of the symbolic anniversary of the 1999 NATO bombings, both Mr. Xi and President Aleksandar Vucic went out of their way to emphasize that their ties are on the rise, with the latter calling Mr. Xi “a leader and president of a great power, (who) will be respected everywhere in the world, but he will not find such respect and such love anywhere like here, in our Serbia.”

The countries upgraded their relationship from the Comprehensive Strategic Partnership they concluded in 2016 to the “Global Community of Shared Future.” This makes Serbia the first European country to join China’s vision for a new global order, which directly challenges the post-1945 U.S.-led world order. Since 2016, some half of Chinese investments in the Western Balkans have been in Serbia. President Vucic showed no sign of concern over the effect these deepening ties with China may have on Serbia’s future with the EU.

The Chinese-financed and primarily Chinese-built $2.9 billion Belgrade-Budapest railway, announced in 2020, has been progressing, mostly on the Serbian side as Hungary works to reconcile China’s technical standards with those of the EU, and the aim is to complete the entire link by 2025. The leg between Belgrade and the Hungarian border may open in 2024. When fully completed, this will create an essentially Chinese transport corridor from the Greek port of Piraeus, which the Chinese firm Cosco bought in 2016, to Hungary via Serbia.

The China hawks

Lithuania and the Czech Republic remain the most principled countries in Central Europe as regards communist China and its malign influence in Europe. They are the most pro-Taiwan and the most vocal in criticizing the CCP’s human rights record. They are not dependent on the Chinese market and have been bullied by China in ways other EU member states have not.

Lithuania was the first to leave the 17+1 framework and earned China’s wrath when, in 2020, it vocally supported Hong Kong, Taiwan and Tibet, and in 2021 renamed its “Taipei Office” as the “Taiwanese Representative Office in Lithuania.” Vilnius held firmly to this position, with support from the EU, after China imposed a trade embargo and secondary sanctions on countries that sourced products from Lithuania – until President Gitanas Nauseda in 2024 took steps to defuse the standoff.

In the Czech Republic, the mayor of Prague in 2019 cancelled a sister-city agreement with Beijing and signed one with Taipei. A 2020 high-profile visit to Taiwan by Czech Senate Leader Milos Vystrcil infuriated China. In March 2023, Marketa Pekarova Adamova, chair of the Czech Chamber of Deputies, led a large delegation to Taiwan and pledged her country’s support for Taiwan.

The Czech political outreach to Taiwan is bearing fruit in business and economics. There have been direct flights from Taipei to Prague since July 2023, while Taiwan’s investment in the Czech Republic, including semiconductor related facilities in Prague and Brno, is several times larger than communist China’s. The Czech Republic has been the EU leader in convening large annual global cybersecurity conferences that highlight the risks to 5G networks from Huawei and ZTE.

The election of Petr Pavel – a Czech general who formerly was Chief of the General Staff and chaired the NATO Military Committee – as Czech president in 2023, replacing former President Milos Zeman, removed the last major pro-Chinese politician from the picture. In addition to regular comments critical of Beijing, President Pavel broke decades of protocol by being the first EU leader to speak with then Taiwanese President Tsai Ing-Wen.

Estonia and Latvia could also be included in this camp because they too have left the 17+1 forum, and reacted strongly to the Chinese Ambassador to France’s 2023 remark – since downplayed in Beijing – that the Baltic states “do not have effective status in international law.” Nevertheless, their critical approach to communist China is not as visible.

The pragmatists

Poland, Romania, Slovakia, Bulgaria and Slovenia continue to take pragmatic approaches to China, with trade and investment generally stable and governments without strong pro- or anti-Chinese positions. Warsaw has long had the most extensive relationship. President Andrzej Duda and the former Law and Justice government pursued Poland’s traditional focus on trade and investment.

Beijing’s support for Russia’s war against Ukraine has reduced that interest, but Mr. Duda still made one of his regular visits to Beijing in June because: “It is important to me that the winds of history and difficult war situations in Europe don’t distort Poland’s economic cooperation with China.” Meanwhile, Chinese joint military exercises with Belarus just across the border near Brest have aroused additional concern in Poland.

Poland’s current government of Prime Minister Donald Tusk, former president of the European Council (2014-2019) and of the European People’s Party (2019-2022), diverges little from this pragmatic approach, although Foreign Minister Radoslaw Sikorski recently told the Sejm, Poland’s parliament, in his inaugural foreign policy address that national security is Warsaw’s top priority, reducing China’s importance. The government’s mantra is: “cooperate where possible, compete where needed, and confront where necessary,” language Mr. Tusk used in the 2021 European People’s Party China Strategy.

Meanwhile, Romanian-Chinese ties have gone from growing and hopeful to stagnant, and now to what some call ambivalent or even an all-time low. China has had a very modest economic relationship with Slovakia, but investment projects worth 5 billion euros are in process, including 1.2 billion euros in an electric battery plant that enjoys generous government subsidies and tax breaks. The government of pro-Russian Prime Minister Robert Fico is even less likely than its predecessor to take a critical approach to Beijing as he prepares to visit in November to sign a strategic partnership agreement.

Bulgaria’s trade relations are modest and China is not even in the top 20 investors there, as political relations lack dynamism while popular attitudes to China are indifferent. Slovenian Prime Minister Robert Golob prioritizes economic cooperation over the Taiwan issue, in which his predecessor, Prime Minister Janez Jansa, had a stronger interest.

Scenarios

Likely: More of the same

Over the past 10 years, China has refined its approach to Central Europe, focusing strategically on states that do not question Chinese policy or goals, that view the EU and the West critically, that are eager to intensify ties and that do not mind supporting Beijing’s interests in the EU and other multilateral settings.

China can be expected to double down on the relationships that meet these criteria – Hungary and Serbia – while waiting for other opportunities to arise. China also sees these states as particularly useful to expanding trade within the EU market, helpful in protecting supply chains and pre-empting any barriers the EU may erect.

Three types of relationships between China and countries in the region have emerged and are likely to continue: Hungary and Serbia prioritized and on an upward trajectory; pragmatic relations without closeness or dynamism with Poland, Romania, Bulgaria, Slovakia and Slovenia; and further difficult relations with the Czech Republic and Lithuania.

Wild cards: Russia, plus European and American elections, create uncertainty

China’s relations and engagement with Central Europe are also subject to external factors. A key element in the short to medium term is to what extent China will continue enabling Russia’s war against Ukraine. The longer China increases this support and the more successful it is in undermining Ukraine, the more likely countries in the region are to view China as a rival or adversary, despite continued trade and economic relations.

Upcoming parliamentary elections in Romania in September and in the Czech Republic in 2025 could produce changes in government that are more favorable to Beijing. Meanwhile, China sees opportunities to intensify its relationship with Mr. Fico’s Slovakia. The government of the Republic of North Macedonia approved in June and led by Prime Minister Mickoski may present another opening for Beijing, which seeks to consolidate the transport corridor from Piraeus in Greece to Hungary, Austria and the center of Europe.

A victory in the United States by former President Donald Trump in November will likely increase U.S. emphasis on the China threat, including pressure to reduce dependence and lessen vulnerability to political or economic coercion. This could increase scrutiny of all relationships with China.

Enjoyed this article? Subscribe to Hudson’s newsletters to stay up to date with our latest content.