Bryan Clark testifies before the House Oversight and Accountability Committee.

Written Testimony

Chairman Grothman, Ranking Member Garcia, and distinguished members of the committee, thank you for the opportunity to discuss the US Department of Defense’s (DoD) wasteful spending and the implications for national security.

The US military has been the world’s most capable armed force since the end of World War II, deterring Soviet aggression against allies during the Cold War and winning wars in eastern Europe and the Middle East through the end of the 20th Century. Much of that superiority resulted from the Pentagon’s development of cutting-edge weapon, network, and sensor technologies that gave US forces an edge over potential and actual opponents.

Transitioning technologies to the battlefield can be enormously expensive and highly disruptive, as we see today in commercial industry’s efforts to create commercial applications for artificial intelligence. However, the DoD should not consider the costs and challenges of maintaining a technically superior military as an excuse for wasting money on programs that are inadequately designed, poorly managed, or no longer relevant. These “white elephants” increase the national debt, which now costs as much to service as the entire US military budget. But more important, overspending on new defense acquisitions takes money away from maintenance, training, and recruiting and retention, leaving our military less ready now and into the future.

The DoD’s poor track record in acquisition since the Cold War is generally not the result of individual malfeasance or ineptitude. The Pentagon’s processes for buying new systems reflect outdated assumptions about military-technical competition that drive overly-ambitious requirements and provide little flexibility to adapt performance demands or use cases. To succeed, acquisition officials have to demonstrate exceptional creativity and initiative. Unfortunately, by definition that means most programs lack the kind of leadership needed to thrive.

Current approaches set programs up to fail

One does not need to look far for examples of the Pentagon’s flawed acquisition process in action. Until last week, the DoD was refusing to accept new F-35 Joint Strike Fighters because they lacked a software update that would enable aircraft to perform theirfull range of missions. However, desperate for tactical air capacity and without space to store more jets at Lockheed Martin’s Ft. Worth factory, the DoD resumed F-35 deliveries without the new software load. This disruption is only the latest for DoD’s largest program, which is a decade late and about $200 billion over its original cost estimates.

The F-35’s problems reside in its origin more than its execution. Born at the end of the Cold War, the Pentagon’s requirement for the F-35 to incorporate stealth, computing power, and a broad array of sensors and weapons demanded technologies that didn’t exist when the program started. These ambitious requirements were amplified by the need for versions of the F-35 to operate from Navy ships, austere Marine Corps airstrips, and Air Force bases in environments from polar ocean to equatorial desert. To meet the program’s schedule, F-35 production began before its final design or underlying technologies were complete. The resulting concurrency drove the cost and schedule overruns that now exemplify the program.

The F-35 is primarily A US Air Force program, but the other US military services have their share of acquisition failures. The Navy’s Littoral Combat Ship (LCS) was started in the early 2000s as a transformational small warship that would use modular packages of uncrewed vehicles to conduct missions such as anti-submarine warfare (ASW), mine clearing, and surface warfare. Through this approach, the LCS could replace several classes of Cold War-era ships that were nearing retirement.

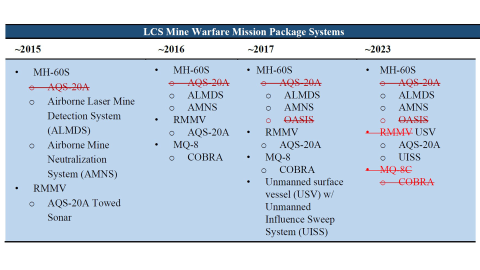

Navy leaders’ vision for LCS never came to fruition. After two decades of development and the purchase of 35 hulls, the Navy finally achieved initial operational capability for the mine clearing mission package in 2023.Over that period, contractors and program managers introduced numerous changes to the mission package’s operational concept and composition as they contended with immature technologies and a lack of direction from Navy leaders regarding LCS use cases.

Like the F-35, the LCS suffered from ambitious requirements that outstripped the technology of the time. After years of development and testing, elements such as the Organic Airborne and Surface Influence Sweep (OASIS), Remote Multi-Mission Vehicle (RMMV), and MQ-8C Firescout fell short of the Navy’s needs and were cancelled after costing billions of dollars for research and development. The figure below captures changes over the second decade of LCS mine warfare mission package development.

Figure 1: LCS Mine Warfare Mission Package evolution 2015 to 2023

The only LCS mission package fielded by the Navy was the mine warfare mission package. Navy leaders terminated the ASW mission package in 2022 after its originally-planned technologies failed to mature and program officials determined available sonar systems were too heavy for the LCS hull to carry. Instead of pursuing a stand-alone LCS surface warfare package, the Navy decided to incorporate its systems into the baseline ship design.

Due to the ships’ $60 million annual operations and crewing costs and limited mission set, the Navy is retiring a third of its LCS fleet well before the end of their service lives—and before some conducted a single overseas deployment. Although some of the dozen retired LCS could be sold or given to allies, they represent a largely wasted investment of more than $6 billion in construction and sustainment.

The US Army’s Future Vertical Lift (FVL) family of systems provides another high-profile example of inadequate return on investment. The FVL program started as an effort to replace multiple classes of Army helicopters that had retired or were nearing their end of service life, but was also envisioned by Army leaders as necessary to maintain the relevance of rotary wing aviation. The experience of US ground forces in Iraq and Afghanistan, reinforced by operations in the ongoing Russian invasion of Ukraine, suggested that helicopters lacked the stealth, speed, and range to survive against man-portable air defense systems (MANPADS) and rocket-propelled grenades (RPG). Moreover, drones of increasing lethality can conduct some of the missions rotary-wing aircraft previously performed.

Army leaders viewed FVL as a key element of the service’s Multi-Domain Operations (MDO) concept, in which ground forces use uncrewed air systems (UAS) and FVL command aircraft to find enemy air defenses and artillery batteries for US aircraft or missiles to attack. FVL troop transports then quickly move assault teams toward or behind enemy lines. To enable this approach, the Army would need to develop FVL aircraft with long range, stealth, speed, and payload capacity for soldiers or ordnance.

The first program to emerge from the FVL effort is the Future Long-Range Assault Aircraft (FLRAA), designated the V-280, which is a tilt-rotor aircraft that can take off and land like a helicopter but fly like an airplane.

Designed to move troops at high speed over long distances as part of MDO, the V-280 was intended to replace the venerable UH-60 Blackhawk in that role. Army leaders already acknowledge that the program’s complexity and rigorous requirements will result in it costing more than $40 million per aircraft—or two to three times the price of Blackhawks the V-280 would replace. To stay within likely future budgets, the Army will pursue a mix of V-280s and new UH-60Ms in its future aviation fleet, despite the vulnerability concerns that spurred the effort to replace Blackhawk in the first place.

However, FLRAA fared better than its sister program, the Future Armed Reconnaissance Aircraft (FARA). After spending more than $2 billion on government research and development and encouraging comparable investments by potential industry partners, the Army cancelled the program earlier this year in belated recognition that UAS and space-based sensors could provide battlefield reconnaissance and crewed helicopters could not survive while surveying enemy positions. It is reasonable to ask if FLRAA would fare any better on those same battlefields and if it will go the way of LCS and eventually be truncated or cancelled as ill-suited for future operating environments.

DoD should adopt competition over recapitalization

Programs like F-35, LCS, and FVL started at a disadvantage because they reflected a common set of assumptions that may have once been accurate:

- The US military is superior to potential rivals and can remain so by pursuing leading-edge improvements in platform performance and automation;

- Major or high-profile platform acquisition programs are needed to spur maturation of related technologies, which otherwise could languish in research labs;

- Operational art is how warfighters win battles, but overall capability and capacity is how the US military wins wars.

Throughout the second half of the 20th century, these assumptions were largely true. The US military was dominant and the DoD only needed to continue recapitalizing its current platforms to remain ahead of would-be competitors. The Arsenal of Democracy was viewed as decisive in winning World War II and capabilities like missile defense, nuclear submarines, stealth aircraft, guided weapons, and communication networks are considered the “second offset” that drove Soviet military spending to unsustainable levels, leading in part to the end of the Cold War.

When the US military was technologically far ahead of potential adversaries, defense officials and their partners in industry could develop new programs over decades to support planned operational concepts. And as the first mover in most military-technical competitions, the DoD could assume future warfighting scenarios would be shaped by US defense capacity and capability, making projections of future force needs more reliable. The DoD codified this approach in service and joint requirements processes during the post-Cold War “unipolar moment” when US military dominance was at its zenith.

In theory DoD requirements processes can incorporate non-material solutions, but rarely do in practice because new tactics or force compositions are seen as near-term responses to battlefield exigencies rather than an enduring way to address an operational problem. However, by focusing on material solutions, requirements processes encourage services to pursue better versions of their current systems, rather than consider a combination of current and future systems that could address a projected capability gap at lower cost, with more adaptability, or in a shorter timeframe. The root case of this misplaced focus on recapitalization is requirements processes do not consider potential future resource constraints alongside their analysis of potential future capability needs.

The requirements-driven approach to defense capability development is no longer valid. First, the US government and DoD no longer lead development of militarily-relevant technologies and provide only a fraction of private and international R&D spending. China’s People’s Liberation Army is now a peer competitor to US forces in several mission areas. And as demonstrated by Houthi rebels, today any group of motivated people can stress US defenses using weaponized drones or simple missiles connected by commercial networks like Starlink and targeted using intelligence from ships’ Automated Identification System transmissions, commercial satellite imagery, or off-the-shelf radars.1

Second, the pace of military innovation is accelerating. Russian jamming is driving Ukrainian troops to adapt their US-supplied GPS-guided weapons with new sensors and artificial intelligence; Houthi forces are fielding new generations of long-range drones to defeat Israeli and US air defenses around the Middle East; and dozens of companies are fielding autonomous vehicles that can recognize and attack preselected targets. The DoD does not have time for new technologies to be fielded only as part of major programs, especially as the number of major programs shrinks in response to defense budget constraints and continued cost overruns. New technologies will need to be incorporated into US forces faster and at the level of sensors, weapons, uncrewed vehicles, or electronic warfare systems rather than only through monolithic multimission platforms.

And third, because the US military is shrinking in size and reaching technological parity with rivals, operational art will once again be necessary for US forces to gain an edge. The war in Ukraine highlights how proliferation and commercialization levelled the technological playing field and advantage increasingly derives from operational innovation. Rather than simply building the best platform, the DoD will need to think of concepts and capabilities together and co-evolve them as new technologies and tactics emerge.

DoD should establish a new “Iron Triangle”

Instead of a requirements-driven process, this suggests an approach more like that used in the commercial world, where development and operations often work hand-in-hand to field a new product to address a user need or problem. Rather than treating a new system as finished when it is deployed, this approach assumes the product and its operational concept or use case will continue to change as it is employed in the field. It is an approach designed for competing with opponents rather than simply recapitalizing with superior hardware to stay ahead of them.

Today, program officials view acquisition management as an exercise in balancing between three factors often characterized as a “Iron Triangle”: program cost, development or production schedule, and system performance. In theory, officials can adjust the parameters associated with each factor to achieve program goals. For example, a service can reduce system performance to lower program cost, or slow development to keep program cost the same while improving performance.

However, in practice a program office can only adjust a program’s development schedule. System performance is dictated by the requirements process and program cost is set by DoD budgets. As shown by programs like LCS and F-35, when ambitious requirements run up against immature technology, program managers are forced to delay development or slow procurement to stay within budget. The end result is higher overall costs because contractors incur overhead expenses every day that they work on a program regardless of whether they deliver a product or not.

The DoD should adopt a new Iron Triangle better suited to an era in which rapid technological change and accelerating battlefield innovations preclude accurate prediction of future needs and allow for tactics and systems to evolve in concert. This approach would need to focus more on the operational problems of the near-term instead of the projected capability gaps of the next decade. A way of describing this approach is depicted below:

Figure 2: The New Iron Triangle

Instead of program cost being treated as a variable in control of the program official, the new Iron Triangle would acknowledge that DoD budgets—not program managers—define the available tradespace. And the most significant driver of costs, as noted above, is requirements. Requirements for long-lived capital investments like crewed ships and some aircraft should continue to address longer-term needs, but these platforms comprise a shrinking portion of the US force and are infrequently replaced.

For the bulk of DoD systems the new triangle would emphasize relevant capability to address near-term operational problems. This goal would capture the importance of adaptability highlighted by today’s combat operations in Ukraine and the Middle East. Focusing on near-term operational problems is also critical to theaters like the Western Pacific, where deterrence depends on creating uncertainty for Chinese leaders regarding US capabilities and concepts. It would also allow program officials to exploit the opportunity in new technologies being offered by start-up companies moving into the defense sector. These companies are already working with troops in Ukraine and elsewhere to field new systems in a form of DevOps.

Another lesson of Ukraine is the need for relevant capacity. Innovative new capabilities cannot make a substantial impact on deterrence or warfighting if they are not fielded at scale. The new Iron Triangle would need to ensure a program’s capability can be developed, deployed, and sustained in sufficient numbers to contribute, be lost to attrition, and subsequently be adapted in response to adversary countermeasures. With overall funding bound by DoD budgets, this sets up a balancing act for program managers between relevant capability and relevant capacity.

The final corner of the new Iron Triangle would enable this balance. Whereas today requirements are largely fixed and reflect a service-driven prediction of future operational concepts and warfighting scenarios, the near-term focus needed in most of today’s defense capability development demands flexibility in how a program is used. For that reason, the third corner of the triangle is the operational concept for the system of systems in which the new program will be employed.

Varying the operational concept for a new system departs from current acquisition processes, but is necessary to enable identifying, developing, and fielding new systems with relevant capability and at appropriate scale within a constrained defense budget. To implement this approach, program managers and their industry partners would need to work directly with operators to identify how systems and technologies could be combined with tactics to yield the capability and capacity needed for their near-term missions. In addition to allowing for a more effective balance between capability and capacity, DevOps-style collaboration would allow exploiting operational innovation as an element of program development rather than only as a work-around employed by service members when predicted requirements end up being wrong.

US defense officials know a shift to near-term capability development is necessary and have begun several efforts to jump-start efforts that implement a new Iron Triangle. The DoD’s Replicator initiative is buying and transition a large number of uncrewed vehicles to address near-term operational problems faced by US Indo-Pacific Command. And within the military services, offices such as the Air Force’s AFWERX and Navy’s NavalX are assessing and acquiring new software and uncrewed vehicle technologies in concert with operators. However, the Pentagon needs to embrace these approaches as the majority of defense acquisition and treat large platform recapitalization efforts like F-35 as the exception.

Conclusion

The DoD can avoid its next generation of acquisition debacles by reducing its emphasis on recapitalizing ships, aircraft, or armor and focus instead on evolving its systems of systems to address rapidly changing security environments and technology opportunities. If defense officials attempt to make future platforms relevant across a broad range of scenarios and threats the resulting requirements will likely create more cost overruns and continued shrinkage of the US force. However, if considered part of an evolving package of crewed and uncrewed systems, current and planned platforms could continue contributing to warfighting while retaining their value as multi-mission providers of peacetime deterrence and crisis response.

Enjoyed this testimony? Subscribe to Hudson’s newsletters to stay up to date with our latest content.